Is Stripe Atlas Worth It In 2024? [Update]

Last updated on

Do you want to start a new online business and wondering if Stripe Atlas is worth it?

Opening a new business can be overwhelming. There’s an entire checklist of tasks to complete before you can begin accepting payments online.

Many entrepreneurs find it easier to outsource the work rather than set up everything themselves. That way, they can focus on improving their products or services and customers’ needs.

In this article, we’ll review what Stripe Atlas is, why it may be helpful for you, and how you can use WP Simple Pay to accept payments on your site as soon as you’re set up as a Stripe Atlas member.

In this Article

What Is Stripe Atlas?

Stripe Atlas is a service developed by Stripe that helps you establish a business in the United States from anywhere in the world. It helps non-US citizens who founded an online business form a legal entity (C-Corp & LLC).

For $500, Stripe will…

- Form a C Corporation or Limited Liability Company (LLC) in Delaware.

- Issue stock to founders of a C Corporation.

- Obtain a U.S. Employer Identification Number (EIN) for tax purposes.

- Open a U.S. business bank account.

- Create a U.S. Stripe account to accept payments from around the world.

- Give you $5,000 in free credits from Amazon Web Services (AWS).

- Let you join the Stripe Atlas Community, a global community of entrepreneurs and experts.

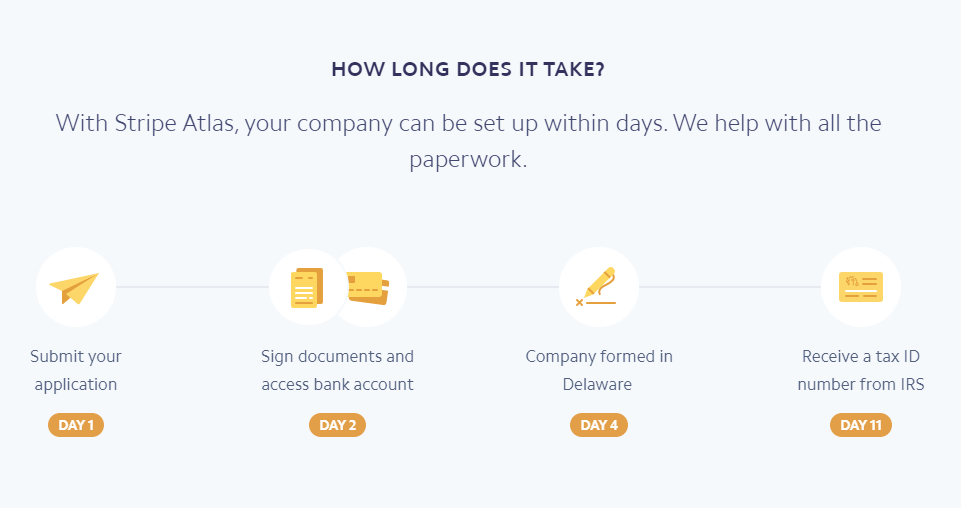

The entire process takes about two weeks.

Why does Atlas incorporate you in Delaware? Delaware is commonplace for new companies, especially those that do business nationally or globally. It offers a number of advantages. Here are the important ones:

- Stock owned by people outside Delaware is not subject to Delaware taxes.

- There is no state income tax for non-residents.

- There is no state corporate tax for companies formed in Delaware that do not do business in the state.

- Shareholders, directors, officers, managers, or members (which includes just about everyone) don’t have to be Delaware residents.

- Taxation requirements are generally friendly to companies with complex capitalization structures and/or a lot of authorized stock.

- Delaware has some of the most flexible business laws in the country.

- The Delaware Court of Chancery focuses solely on business law, has lots of expertise in the subject, and uses judges instead of juries.

It’s also worth pointing out that Stripe is not the only company providing this kind of service. Countless attorneys, accountants, and business consultants will set up your company quickly for a flat fee.

Atlas is a way for Stripe to leverage its brand and bring people into its payment platform.

Why Should You Use Stripe Atlas?

There are four major benefits of using Stripe Atlas.

1. You Can Set Up a Business From Anywhere

If you aren’t from or living in the United States, setting up a company here can be challenging. You must travel to the United States or find someone to represent you. Your lack of citizenship or residency status means you’ll have to jump through additional hoops.

With Stripe Atlas, you simply fill out your application and let them handle all the legwork.

Why not set up a company in your home country? Investors don’t need many reasons to pass you over. As a foreign business, they might decide you aren’t worth the hassle or complexity.

So, if you’re serious about your business and plan to earn money in the United States, you’ll want an American-based business.

2. Stripe Atlas is Remarkably Fast

We’re not sure how Stripe manages to finish everything so quickly, but two weeks is incredibly fast for something like this. It probably uses a combination of software, people, and expedited channels, like an instantaneous way to open a bank account. You could spend twice that much time deciphering paperwork, let alone sending things through the mail.

3. Stripe Atlas is Simple and Hassle-Free

You may be a bootstrapper, but convenience still has value. Sometimes, it’s easier to outsource a task to someone who will do it much faster and, more importantly, better than you will. Mistakes can be costly.

Once your business is set up, you become part of Atlas’s global community of founders and entrepreneurs.

4. Stripe Atlas is Affordable

Since Atlas includes the Delaware filing fee, you’re actually only paying $311 for Stripe’s service. That’s fairly cheap, considering the whole process would take several hours of your time. It’s considerably cheaper than hiring an attorney to set it all up.

Plus, you get other benefits like access to free products and discounted pricing from Atlas partners, prepared documents, and someone to walk you through everything. These all make the service even more valuable.

Remember that Stripe charges $100 per year to be your registered agent once Atlas has established your business.

Why Shouldn’t You Use Stripe Atlas?

Those are great benefits, but that doesn’t mean Atlas is necessarily right for you. Let’s explore some of its drawbacks and reasons to consider alternatives when it comes to incorporating your business in the United States.

1. You Could Do it Yourself

Technically, Stripe Atlas doesn’t do anything for you that you couldn’t do yourself. It may be fast and reliable, but they don’t have any special access or permission that is unavailable to you. Essentially, you’re just paying someone to handle the paperwork.

If you’re an early startup on a super tight budget, you may not be able to throw $500 around for a little convenience. If that’s the case, you’ll want to open your own company manually. You could do everything yourself with some research and hard work.

2. You Have to Incorporate in Delaware

If you use Stripe Atlas, you must incorporate your company in Delaware. They don’t allow you to choose another state. Delaware offers some special advantages to new companies, but that doesn’t mean it’s the right place for your company. If you need to open your company in another state, Atlas can’t help.

3. You Need to Know your Business Type and Model

Stripe Atlas might not be right if you don’t have a clear business model yet. Atlas asks for a detailed description of your company for tax purposes, but you may not have all the information it needs if you are a new startup.

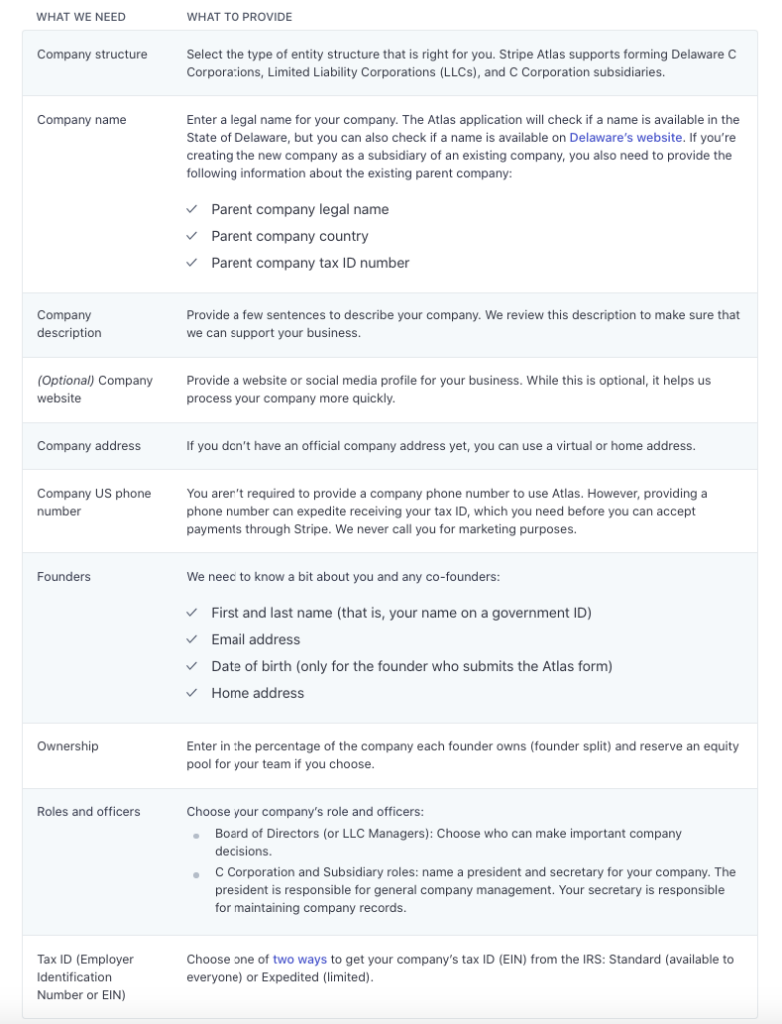

Here is what Stripe Atlas requires from you:

4. If You’re a Restricted Business

If you are on the list of Stripe restricted businesses, you cannot use Atlas. We don’t know for sure, but since Atlas is so affordable, Stripe probably doesn’t make much money. The purpose of Atlas, we think, is to bring new businesses into Stripe’s platform. So, if they won’t process payments for you, they won’t want to set up your company.

5. If You’re Outside the US & Don’t Do Business in the US

If you won’t do business in the United States, you can’t be incorporated or have a bank account here, so Stripe can’t help you.

6. If You’re From a Restricted Country

Due to restrictions from the United States government and Stripe’s financial partners, they can’t work with you if you’re from the following countries.

- Central African Republic

- DR Congo

- Cuba

- Iran

- Iraq

- Lebanon

- Libya

- North Korea

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- Ukraine

- Venezuela

- Yemen

7. If You Don’t Need to Incorporate

If your company is in the early stages and doesn’t have any customers or make any money yet, you may not need to incorporate it. Many businesses survive a long time as simple sole proprietorships or partnerships.

So Is Stripe Atlas Worth the Money?

Yes. We think $500 is a good deal for Stripe’s service. That isn’t to say it’s right for every new business, but most people find it fast, affordable, and simple.

The founders of Rapidr, a customer feedback management software startup, agree it’s worth the money. Khushbu from Rapidr explains…

“Overall, our experience with Stripe Atlas was phenomenal and mostly painless. If you look into the competitors, Stripe Atlas might look a tad bit expensive, but with that, you get access to world-class support and brands. Before the entire process, we reached out to a competitor, but they never responded to the inquiry. Ouch. We sent two support inquiries to Stripe, and both were responded to within 24 hours.”

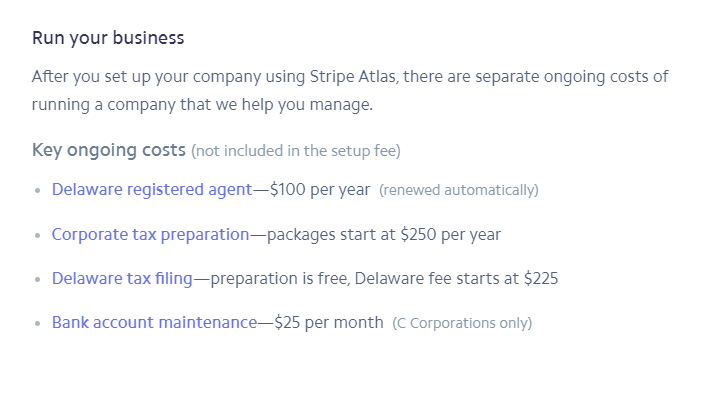

We should also mention that there are some ongoing costs beyond the $500. These are outside of Stripe’s control. Plus, you would pay these additional costs anywhere, even if you opened a company yourself.

The bank account maintenance fee and registered agent fees are unavoidable, but the tax preparation and filing fees are optional. You may handle those yourself or use another service, but having Stripe do it for you since they already have your information is very convenient.

Setting Up WP Simple Pay as a Stripe Atlas User

We hope this information has helped you determine if Stripe Atlas is a good option for your business.

One of the best parts about being a Stripe Atlas member and using Stripe as your payment processor is that you can begin collecting online payments quickly and easily with WP Simple Pay. It’s the best Stripe payments plugin for WordPress, letting you create payment forms, enhance customer communication, and accept online payments directly on your site without setting up a shopping cart.

If you’ve decided to let Stripe Atlas set up your online business, you should be using WP Simple Pay on your WordPress site. Additional features of the plugin include:

- Multiple Payment Methods: To drive more conversions on your site, you can accept 10+ payment methods, including ACH Direct Debit, credit/debit cards, digital wallets, Alipay, Bacs Direct Debit, and more.

- On-Site Payment Forms: Use WP Simple Pay to effortlessly embed payment forms directly on your site, helping to reduce checkout abandonment.

- Dedicated Landing Pages: Create distraction-free payment pages as you create your payment forms with the form builder.

- Advanced Drag and Drop Form Builder: The plugin’s no-code payment form builder allows you to create the perfect payment forms in minutes without coding.

- Cancelled Subscription Emails: Win back lost customers by sending personalized cancellation confirmation emails.

- And more…

To get started with WP Simple Pay, visit the pricing page and select the plan that best suits your needs. Next, simply install and activate the plugin on your WordPress site.

Once you’ve installed and activated the plugin, its advanced setup wizard will walk you through setting up your account and connecting your site to your Stripe account. Unlike other Stripe payment plugins, WP Simple Pay doesn’t require you to manually enter your API keys. The entire process takes less than five minutes!

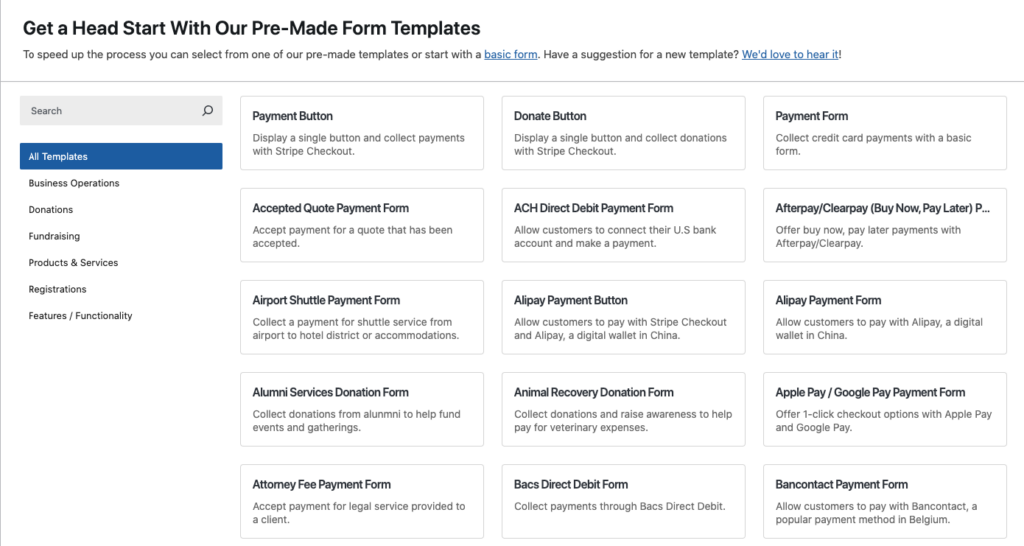

As soon as you’ve activated the plugin and connected your Stripe account, you can choose from tons of pre-built templates or start from scratch to meet your specific needs.

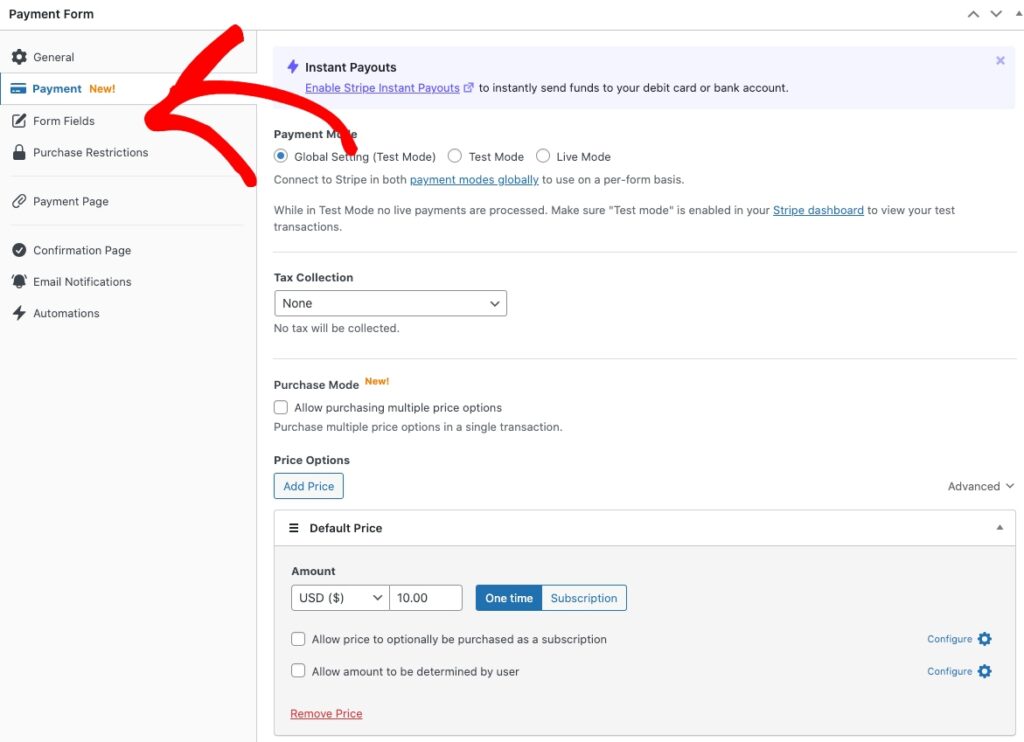

Using the payment form builder, you have the flexibility to add price amounts and multiple quantity capabilities, as well as customize your purchase restrictions, form fields, and email confirmation messages.

Advanced features like Automatic Change Notices, Optimized Payment Confirmation Pages, and All-in-One Purchase Summary Smart Tags are available within the plugin to help you create payment forms with ease and provide customers with complete transparency throughout their purchases.

One additional thing worth noting is that with a Pro plan, you can pass the Stripe processing fee on to your customers during checkout.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

We hope this article has helped you determine if Stripe Atlas is worth it for your business and how you can use WP Simple Pay to collect payments on your WordPress site.

If you liked this article, you might also want to check out the following guides:

- What is Stripe and How Can It Help Your Business?

- 9 Unique Facts About Stripe You Didn’t Already Know

- How to Use AI to Block Fraudulent Payments in Stripe

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.