9 Unique Facts About Stripe You Didn’t Already Know

Last updated on

Do you want to know more about Stripe?

We’ve made it no secret that we believe Stripe is the best payment processor for most online businesses. Its extensive suite of tools, easy setup, and competitive prices offer value to businesses of all sizes.

While the product is undoubtedly great, we also believe the company itself is quite interesting.

In this article, we’ll share a few unique facts about Stripe to help you decide if it’s the best option for you.

In This Article

- 1. Processed Over $1T in Payment Volume

- 2. Stripe Doesn’t Just Process Payments

- 3. Stripe Works Closely With Some Governments

- 4. Stripe Doesn’t Want to Be PayPal

- 5. PayPal Founder Peter Thiel Was an Early Investor

- 6. It’s Nearly Impossible to Avoid Stripe

- 7. Stripe Has Always Been a Developer-First Product

- 8. Stripe Founded by the Collison Brothers

- 9. Stripe Learns from Its Users

1. Processed Over $1T in Payment Volume

In 2023, Stripe processed over $1 trillion in payment volume, making it the largest private fintech company.

Its founders attributed the growth to Stripe’s enterprise business, startups adopting its products, and billing and tax services.

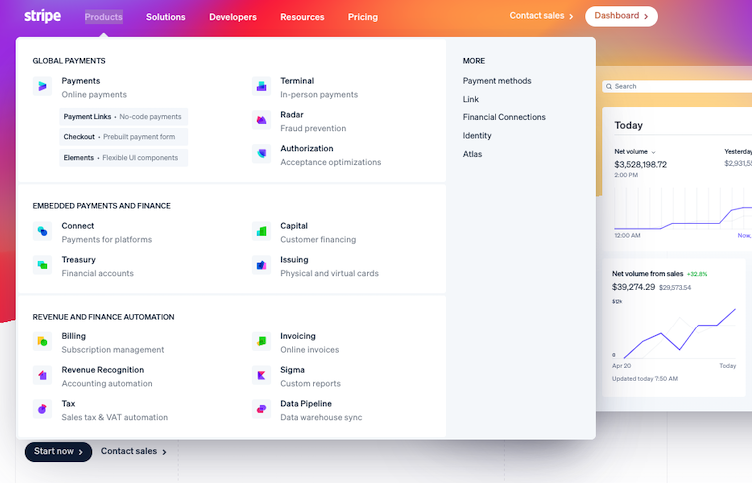

2. Stripe Doesn’t Just Process Payments

Stripe isn’t just a tool for accepting money from your customers and depositing it in your bank account. The company has also developed a complex suite of tools and resources to help you sell more online.

- Billing: Lets you create complex billing systems for any pricing model.

- Connect: Lets you create a marketplace for buyers and sellers to work together.

- Radar: A suite of machine-learning fraud detection tools.

- Terminal: Unify online and in-person payments.

- Atlas: A fully managed business creation service.

- Sigma: An SQL-powered analytics tool.

- Issuing: Lets you create, distribute, and manage physical cards.

There are also countless integrations to make Stripe work with any tool or app you could possibly need. Over time, we expect Stripe to release new tools that bring more online businesses and entrepreneurs into its ecosystem.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

3. Stripe Works Closely With Some Governments

Stripe is best known for making it easy for small businesses, startups, and entrepreneurs to collect online payments. However, the company has another arm that works on massive government projects.

The British Government, for example, uses Stripe to process payments for many of its agencies and departments. They have a broad contract with Stripe so any new agency can sign up and start processing payments just as quickly as anyone else.

4. Stripe Doesn’t Want to Be PayPal

While it’s true that Stripe and PayPal compete for some of the same customer bases, Stripe isn’t trying to be another PayPal.

Where PayPal focuses on the end consumer (buyers and sellers), Stripe is also concerned about developers, middlemen (like marketplaces), and companies that have unique billing needs.

To learn more, see our article: PayPal vs. Stripe: Which Payment Processor is Right for Your Business?

5. PayPal Founder Peter Thiel Was an Early Investor

If you’re familiar with startups, you’ve probably heard the name Peter Thiel. He’s well known for starting Palantir and being Facebook’s first outside investor. Thiel has made investments in AirBnB, Linkedin, SpaceX, Quora, and Yelp and launched PayPal.

Interestingly, Thiel was also an early investor in Stripe through Founders Fund, his venture capital firm. Other members of the fund include Max Levchin and Elon Musk. It’s said Thiel had a heavy influence on the startup’s pricing model.

6. It’s Nearly Impossible to Avoid Stripe

Even if you don’t use Stripe to process payments, your money has probably passed through Stripe’s sphere of influence at some point. Stripe doesn’t just process payments for small startups and freelancers. It also processes payments for some of the biggest online stores and services.

Here are just a few companies that work with Stripe. Chances are you have used some of these yourself.

- Spotify

- Ford Motor Company

- Lyft

- Target

- Task Rabbit

- Doordash

- Squarespace

- Salesforce

- HubSpot

- DocuSign

- Open Table

- Shopify

- Instacart

- Amazon

7. Stripe Has Always Been a Developer-First Product

Stripe’s marketing model has always been to target and please developers first. The plan was to create a product that developers and bootstrappers love. They would become an evangelist of the product and recommend it to their clients and partners.

For example, if a new business needs to accept payments online, the owner might hire a developer to build a website. The developer would then steer the client toward Stripe because it makes his or her life easier.

This is how Stripe avoided marketing in its early days. It focused on building a great product and letting the information spread through word of mouth.

How do they make developers’ lives easier? Stripe’s API and documentation are renowned for being easy to use and fast to implement. It supports multiple programming languages so users can build their own forms and integrations. Stripe also has a robust testing feature to make sure custom code works.

Stripe’s developer-first approach is one of the reasons we chose to partner with the company for our WordPress plugin, WP Simple Pay.

8. Stripe Founded by the Collison Brothers

Stripe was founded in 2010 by Irish entrepreneurs Patrick and John Collison. These brothers started working on Stripe together, and their vision has shaped the company’s success.

Collison says they spent about $10 per day and worked in public cafes and restaurants in Buenos Aires. They were able to devote themselves entirely to Stripe and built their first prototype in just one month.

Impressively, they didn’t wait to find customers, either. They had their first user in just one week. Rather than wait to build something polished and professional (like Stripe is now), they built quickly and extracted feedback from users. They didn’t guess what people wanted. They actually asked people.

9. Stripe Learns from Its Users

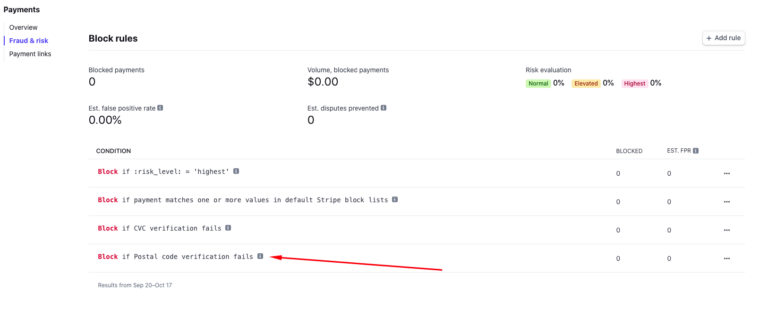

Machine learning is a big part of Stripe’s ability to onboard users and protect you (and itself) from fraudulent transactions. The more people use Stripe, the more it learns how to better serve us and defeat scammers and hackers.

How does it work? Basically, Stripe Radar will take a close look at your transactions to learn about your customers. Then, it lets you create rules to protect yourself from fraud.

For example, Radar enables you to create a rule to “block all transactions when the billing address doesn’t match the card’s country.”

What makes Stripe’s machine learning fraud detection so powerful is how it identifies fraud signals.

For example, Stripe can detect if the round-trip time between Stripe and the end user is too long, which might signal that the buyer is disguising themselves with a proxy or VPN. No other payment processor offers that kind of granular analysis on every transaction.

For more information, see our detailed guide on how to protect your WordPress site from fraud.

There you have it! Hopefully, this article helped you understand more about Stripe, a company that continues to disrupt the online business industry.

If you liked this article, you might also want to check out the following articles:

- 4 Best Stripe Dashboard Feature Updates in 2024

- How to Customize & Manage Stripe Payment Reports

- The Complete Guide to Setting Up a Stripe Checkout Page in WordPress

- Is Stripe Atlas Worth it in 2024?

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.