How to Use AI to Block Fraudulent Payments in Stripe

Last updated on

Do you want to use AI to block fraudulent payments in Stripe?

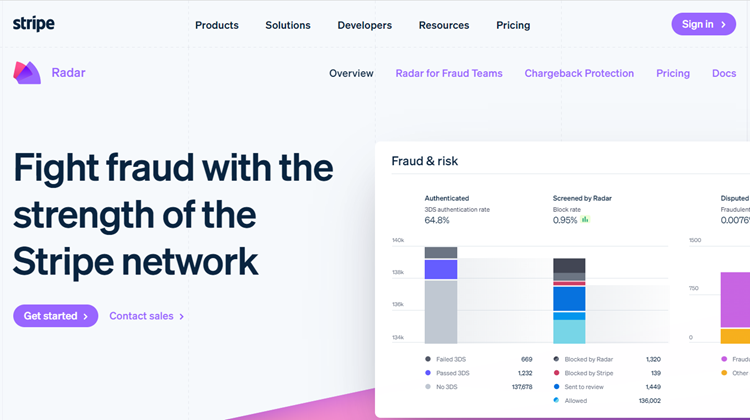

Stripe’s AI-based fraud detection system, Radar, identifies fraud without blocking legitimate payments. Many online businesses that use Stripe as their payment processor find that Radar is more accurate than other third-party tools because it uses machine learning to predict fraud based on large data sets.

In this article, we’ll talk about how to use Stripe Radar to block fraudulent payments on your WordPress site.

In This Article

What Is Stripe Radar?

Stripe Radar is a tool that comes built-in with all Stripe accounts to protect businesses like yours from fraud.

When most payment processors recognize fraud, they often simply block the payment without letting you know why. With Radar, Stripe gives you more control over what kind of payments get blocked and what gets accepted on your website.

Simply put, Radar is a machine learning detection algorithm that identifies fraudulent activity in payments made on Stripe’s platform. It assesses over 1,000 characteristics of each transaction to block fraudulent ones. Last year, the AI-based system reportedly saved over $400 million in fraud.

What Is Radar for Fraud Teams?

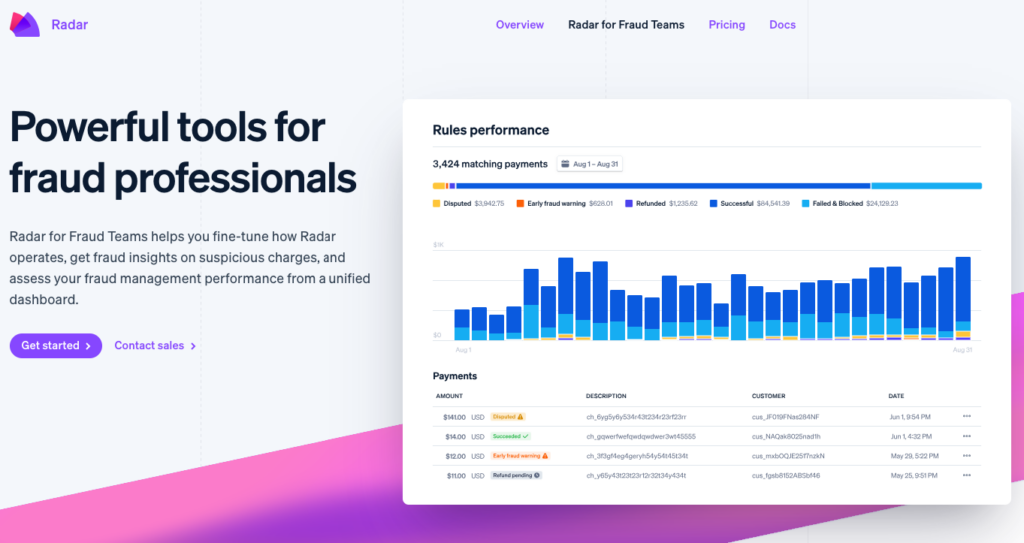

Radar for Fraud Teams is a paid product designed for companies that are especially prone to fraudulent transactions and willing to invest more deeply in protection.

To be clear, Radar for Fraud Teams is a separate product from Radar. Everyone gets Radar, but you have to add Radar for Fraud Teams to your account and pay the additional $0.02 per screened transaction.

According to Stripe, “Radar for Fraud Teams helps you fine-tune how Radar operates, create custom fraud rules, and optimize manual reviews. See fraud insights, assess rule performance, and view manual review efficiency from a unified dashboard.” It comes with a few unique benefits:

- View new types of data related to your payments when you review them to determine if they’re fraudulent or legitimate.

- Set custom risk thresholds based on a numerical score so you can determine your own fraud comfort.

- Create and maintain lists of attributes (card numbers, IP addresses, emails, etc.) to consistently block and allow.

- View better feedback when you create new rules by seeing how they affect your historical data.

- Look at payments holistically (rather than in isolation) by comparing them to previous related payments that match similar attributes.

- Explore and evaluate your fraud prevention efforts with rich analytics.

Essentially, Radar for Fraud Teams gives you more control over Stripe’s fraud system so you can make changes specific to your business. It’s designed for companies with special people or teams that prevent and rectify fraudulent activity.

Connecting WordPress to Stripe

If you haven’t already, you’ll need to connect your Stripe account to your WordPress site to use Stripe’s AI-based fraud protection tools. You can do this by simply installing and activating WP Simple Pay, the #1 Stripe payments plugin for WordPress, on your site.

The plugin allows you to easily accept Stripe payments directly on your site without needing a shopping cart or additional plugins. Its setup wizard makes it super easy to connect your Stripe account without having to enter your API keys manually.

To learn more, see our detailed guide on how to accept Stripe payments in WordPress.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

How to Use Stripe Radar

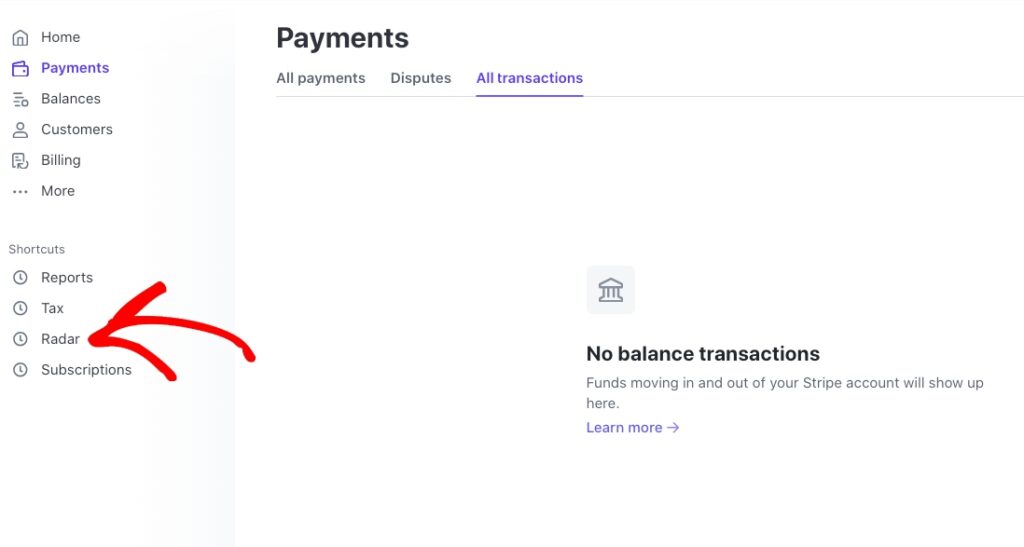

Once you’ve installed and activated WP Simple Pay in WordPress and connected your Stripe account, you can access Radar through the dashboard.

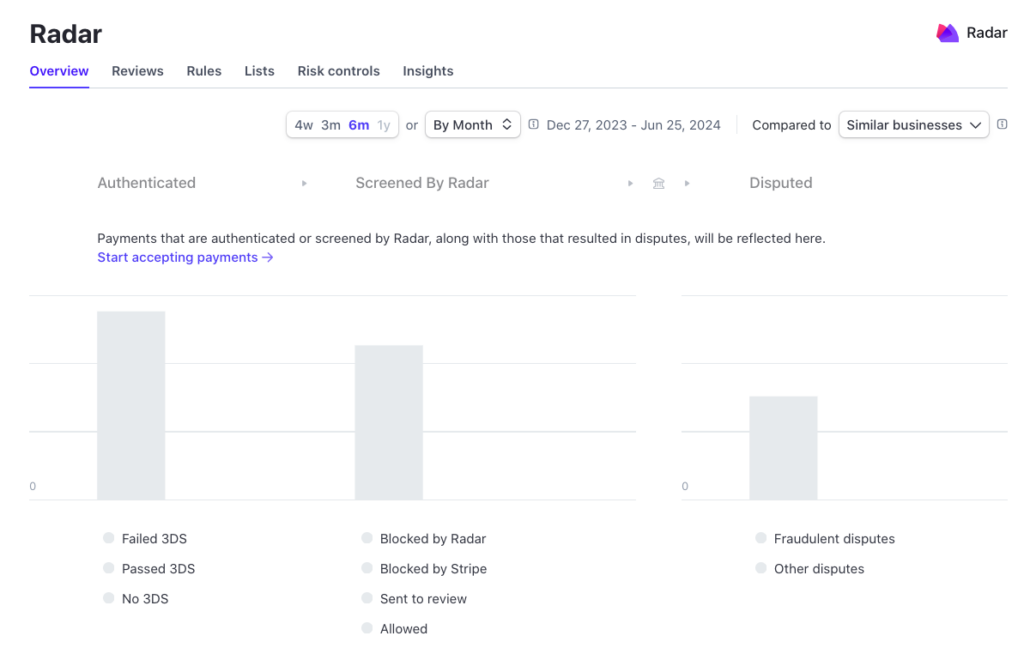

Under that link, six tabs will appear.

- Reviews: Write custom rules based on your business-specific needs, set up and improve manual reviews with detailed fraud insights, adjust how much Radar blocks based on your risk tolerance, and more.

- Rules: Add custom optimizations to Radar based on your unique goals.

- Lists: Create lists, like a suspicious email domain block list or a trusted IP address allow list, to reference in your rules.

Stripe Radar uses machine learning as part of its fraud detection system, which means it gets smarter over time based on your transaction history and new data from the Stripe team. The purpose is to avoid the “one size fits all” approach to payment processing that most processors offer.

Over time, you’ll want to get the most out of Radar by setting your own protection rules. By adding rules, you can make customizations to the tool to support your preferred payment workflow. You can set three types of rules:

Authentication Rules: Implements 3D Secure to verify card transactions.

Block Rules: Let you block payments you strongly think are fraudulent, even if Radar doesn’t catch them. For instance, you might block payments from a particular country or a type of card.

Review Rules: Place any qualifying payments into a review queue for you (or someone on your team) to review personally. For instance, you might insist on personally approving all payments over a certain dollar amount. Note: Review Rules require an upgrade to Rader for Fraud Terms.

Using Stripe Radar Assistant

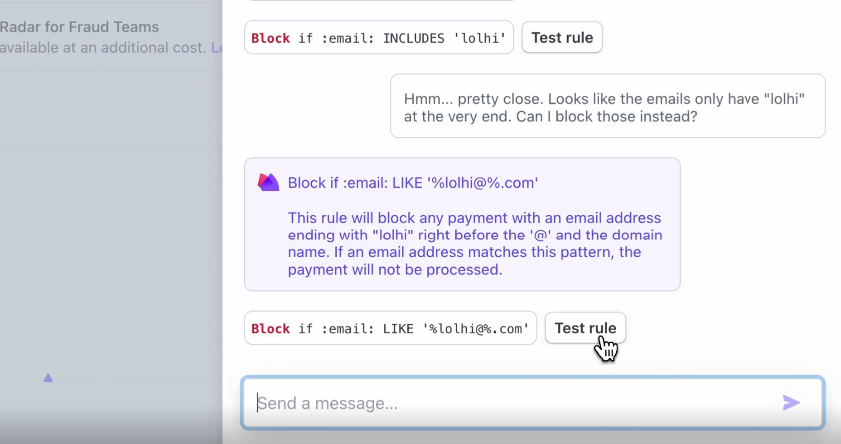

One of the best parts about Radar is that it offers an AI-powered tool, Stripe Radar Assistant, to help you create fraud rules using natural language prompts. These prompts can be used to customize your fraud protection rules.

Using Radar Assistant, you can create rules with hundreds of attributes, including IP address, card details, behavioral signals, and metadata in minutes. You can also test rules to see how they would impact their fraud strategy before implementing them.

Stripe’s AI instantly interprets instructions and automatically generates the required code.

Protect Yourself From Fraudulent Payments

Although credit card companies have become better at responding to fraud disputes, it’s still better to prevent fraud in the first place. Instead of trying to fight disputes and chargebacks, it’s best to prevent fraudulent transactions before they ever occur.

With a tool like Stripe Radar, you can build your business without worrying about the cost of fraudulent activity.

If you liked this article, you might also want to check out the following articles:

- Friendly Fraud: What Is It and How to Protect Your Business

- What Are Chargebacks & How to Win Disputes

- 4 Best Stripe Dashboard Features Updates in 2024

- How to Get Stripe Dashboard (Payment Reports) in WordPress

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.