What Are Chargebacks & How to Win Disputes (5 Tips)

Last updated on

Do you want to know what chargebacks are and how you can fight them?

Chargebacks can be a frustrating part of running an online business, but there are ways to fight them.

In this article, we’ll provide an in-depth look at chargebacks along with the best ways to respond to them.

In This Article

What Are Chargebacks?

Chargebacks, also referred to as payment disputes, occur when a cardholder asks the card-issuing bank to reverse a transaction. If the card-issuing bank agrees with the customer, the transaction amount is removed from your merchant account along with any applicable fees. Chargebacks can occur with both debit cards and credit cards.

Consumers need the ability to dispute payments to protect themselves from unauthorized transactions and inappropriate behavior by merchants. While chargebacks play a healthy role in our financial system, they can be a real pain for merchants when customers submit disputes in error or fraudulently.

Although the chargeback system was designed as a last resort for consumers, more than 80% of them admit to filing a chargeback solely out of convenience. This type of behavior can have a negative impact on your bottom line and the growth of your business.

Depending on your payment processor, chargeback fees vary. For example, Stripe charges $15 per chargeback and does not refund this fee even if you win the dispute. This is to compensate them for the time it takes to manage your case and to discourage you from acting in ways that attract chargebacks.

As you can see, these simple disputes can cause a lot of hassle for online businesses in terms of time, money, and image.

One important thing to keep in mind is that chargebacks are not refunds. If a customer wants their money back, they’re supposed to contact you first. You can initiate refunds at any time through your payment processor to avoid risking your reputation and facing chargeback fees.

You should never instruct your customers to file a dispute to get their money back.

Why Do Customers File Chargebacks?

Every situation is different, but here are the main reasons customers file chargebacks:

- The customer never received the item or service they ordered.

- The product or service was charged at a higher rate than the customer expected.

- The customer expected a refund but didn’t receive one promptly.

- The customer doesn’t believe you provided a quality product or the product or service as advertised. This type of chargeback often occurs after the merchant denies the customer a refund.

- The customer doesn’t recognize your name on their bank statement, leading them to believe someone charged them fraudulently.

- The customer asked you to cancel their recurring payment, but for some reason, the next charge went through.

- The customer tried to commit fraud. Upon investigation, they may claim they never received the product or service. Or, they may hope you neglect to fight the chargeback.

The Chargeback Process

During a dispute, the funds are kept out of your merchant account until a resolution has been established. If the bank rules in your favor, the funds are returned to you. This process generally takes 60-90 days. The degree to which you’re involved is different for each payment processor.

Here’s how the process usually occurs:

- The customer makes a purchase online, in person, or through an app.

- The customer initiates the chargeback for one of the reasons we outlined above by contacting their issuing bank (the credit card company).

- The issuing bank communicates with the merchant’s bank about the claim.

- The merchant’s bank asks the merchant for evidence to refute the claim, like invoices, proof of delivery, recipients, the return and refund policy, or anything else that indicates the transaction was legitimate and valid.

- The card-issuing bank reviews the evidence and decides whether the purchase was valid. This part of the process takes the longest.

- The card-issuing bank shows the evidence to the customer. The customer can either accept the transaction or continue the dispute through arbitration. If the card issuer determines the transaction was invalid, the customer gets his or her money back.

- If the merchant and issuing bank fail to agree, they go through an arbitration process that’s governed by the issuing bank. The decision is final.

Part of contesting a payment dispute means sending a chargeback rebuttal letter to the card-issuing bank. Stripe automatically notifies merchants about chargebacks and provides tools for evidence submission.

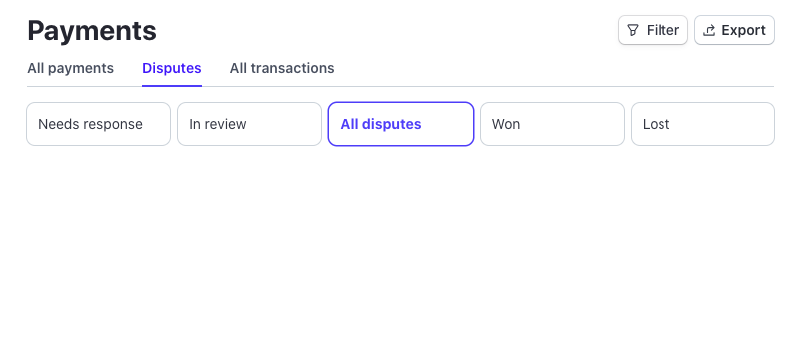

For example, you can easily view disputes directly from your Stripe dashboard. By clicking on a listed dispute, you can access more information on that specific case and what you need to do to defend yourself.

Stripe also offers an optional service, Chargeback Protection, that provides merchants with protection against chargebacks. Merchants who participate in Stripe Chargeback Protection pay an additional 0.4% of the transaction amount per transaction.

How to Fight Chargebacks

As a merchant, you should never assume that all chargebacks are valid. If you think a chargeback is illegitimate, fight it using the process laid out for you by your payment processor.

In case you were wondering, only about 60% of merchants fight chargebacks. It’s worth fighting chargeback disputes to avoid loss in revenue, keep your business in good standing, and counter fraudulent chargeback claims.

The steps outlined below will increase your odds of winning the case.

1. Contact the Customer Directly Regarding the Chargeback

Sometimes customers will dispute a payment with their card issuer before ever speaking with you.

Talking to the customer can clear up confusion quickly. For instance, if the customer didn’t recognize your name on their statement, you can explain that the charge came from you. If the customer has a complaint about your product or service, you can resolve it without involving the issuing bank. Then, simply ask the customer to drop their chargeback claim.

With all of that being said, don’t rely on the customer to drop their complaint. Follow the chargeback process required by your payment processor. Make sure to include evidence, like receipts and email conversions, to prove that the issue has been resolved.

2. Respond to the Chargeback Dispute Quickly

Card-issuing banks set deadlines for your responses to chargebacks. They generally give you 7-10 days to respond to the claim with evidence.

If you miss a deadline, you automatically lose the case. There’s no leeway with this requirement, so make sure you supply everything that is asked of you as quickly as possible. With that being said, don’t rush to submit until you have all the evidence you need to support your case.

3. Provide Thorough and Robust Documentation

Card-issuing banks are looking for documentation and evidence that the customer ordered and received the product or service legitimately. Send screenshots of tracking information, email correspondence, notes from phone calls, and any other documentation available. Include your documented return, refund, shipping, and exchange policies if relevant.

It’s always better to send more information than you think you’ll need. If something develops after you submit your evidence (maybe you and the customer have a conversation you want to mention to the issuing bank), be sure to send that too.

Most importantly, be sure to provide any documentation the issuing bank specifically requests. That will be critical to winning your case.

4. Respond to the Chargeback Code

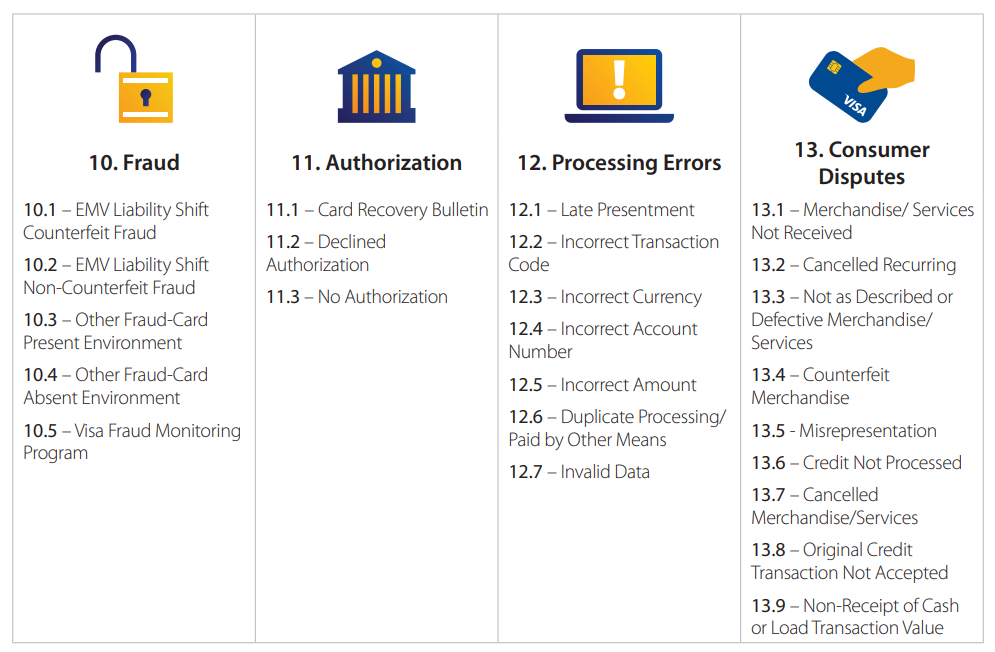

Your initial chargeback notice will include a “reason code” that classifies the reason that the customer requested the chargeback.

For example, Visa chargeback codes are organized into four categories.

Be sure your response to the card-issuing bank provides your story and evidence that responds to the code.

If the chargeback reason code alleges that the product is counterfeit, you should provide evidence that it isn’t. If you don’t address the customer’s specific issue, there’s a good chance you’ll lose the case.

5. Concede If You’re in the Wrong

Let’s say you speak to the customer and learn that their payment dispute is valid. Perhaps you made a mistake or fell short of their expectations. In these cases, it’s best to refund the customer and send evidence of the refund to the card issuer.

If you simply let the dispute play out and lose the case, you’ll end up with a chargeback on your record. If you get too many chargebacks, you may be dropped by your processor or refused service by the card-issuing banks.

Sometimes, it may be best to refund the customer even if you think you’re right because it’s not worth fighting the chargeback.

If a customer claims you never performed a service and you don’t have any evidence to prove that you did, there’s a good chance you’ll lose the case. In this instance, it may be smarter to send the refund, report the refund to the issuing bank, and then improve your workflow to create evidence of every sale.

There you have it! We hope this article has helped you learn more about chargebacks and how to fight them.

If you liked this article, you might also want to check out our guide on how to avoid payment disputes with a return and refund policy.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.