How to Avoid Payment Disputes With a Return & Refund Policy

Last updated on

Are you frustrated with online payment disputes and wanting to implement a return and refund policy to protect your business?

Returns, refunds, and exchanges are inevitable for all online businesses regardless of what you sell. In fact, out of the $1.3 trillion in online sales registered in the U.S., approximately 16.5% ended up as returns in 2022.

As a business owner, getting a return request or a refund request can be painful. It’s a sign that your products or services don’t meet your customers’ expectations. It also subtracts a little bit of money from your pocket, which is especially frustrating.

In some cases, some buyers use refunds and returns as opportunities to commit fraud. These bogus claims can cost you time, money, and your reputation with the card-issuing banks.

It might surprise you to learn that 30% of all online shoppers intentionally look for ways to overspend and return the products they don’t want later in exchange for a refund.

In this article, we’ll explain how you can create and add a return and refund policy to your site to avoid online payment disputes, combat fraud, and remove unwanted conflicts with your customers.

Table of Contents

What Is a Return Policy?

A return policy is a set of rules that explains to customers what can be returned and/or exchanged. It should also cover the reasons you’ll process a return and the timeframe. Let’s take a look at the two most important components of a return policy.

1. Internal Policy for You and Your Team

First, there’s the internal policy that governs how you and your team behaves. It’s important that everyone who handles customer purchases and accounts understands the policy and follows it closely.

Your policy will vary depending on the nature of your products or services and your business model, but generally you should include these details:

- What can be refunded, returned, or exchanged.

- Which products or services are final sale (non-refundable for any reason).

- The window of time they have to make a request.

- The condition of the products or services (for instance, you might only refund software purchases if the files were never downloaded).

- The process for initiating a return, refund, or exchange.

- What they get for a return (e.g., money back, store credit, etc.).

- How to contact you with any questions about the policy.

2. Documented Policy for Customers and Prospects

Second, there’s the actual written document that you publish for customers and potential customers to read somewhere on your site. This should be an easy-to-find page that outlines the entire policy in a comprehensive, yet clear manner.

A written policy lets you treat all refund and return requests the same way, as opposed to handling all requests on a case-by-case basis. Treating each request differently is unproductive, expensive, and exposes you to accusations of bias and unfairness.

It’s important to make your policy available to customers before they purchase so there are no surprises. You don’t want customers complaining that they couldn’t find your policy. This means placing the policy (or at least links to it) in key places on your site:

- Footer

- FAQs Page

- Chat Feature

- Shopping Cart Page

- Checkout Landing Page

- Sidebars

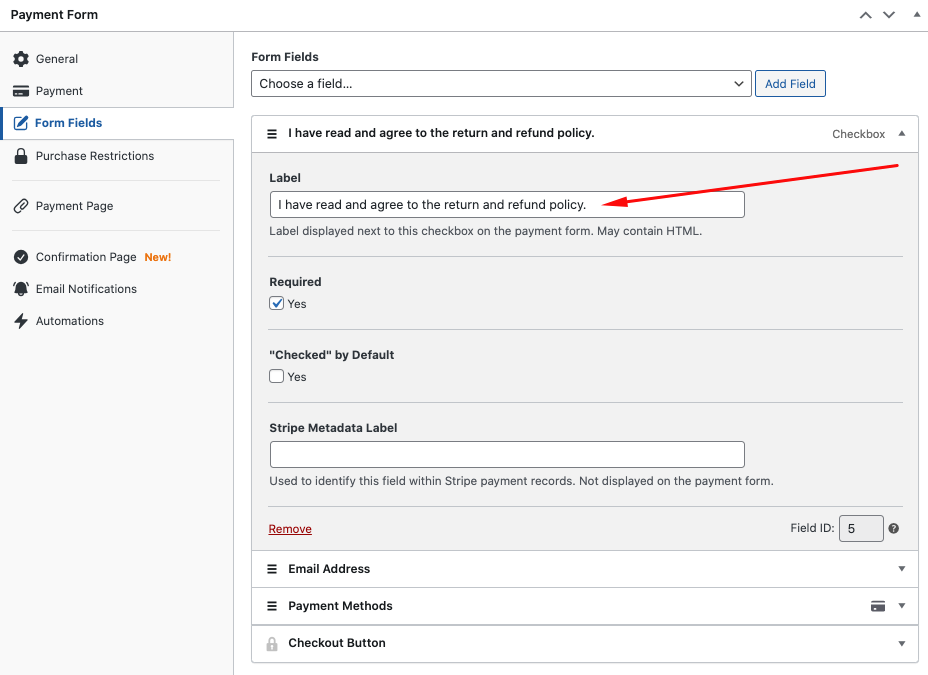

If your refund and return policy is especially tight (maybe you really can’t offer refunds), it helps to force your customers to check a box near their payment form that indicates their agreement to the return policy. This will also help your case if you ever have to defend yourself against a chargeback because you have evidence that the customer agreed to the policy’s terms.

If you’re already using WP Simple Pay to accept payments on your site, you can easily add this type of checkbox to an embedded or overlay payment form using the plugin’s advanced drag-and-drop form builder.

Customer-Centric Policies

It’s tempting to declare “No refunds!” but that’s rarely a smart strategy. The ability to return an unsatisfactory purchase is a big motivator for customers to buy in the first place.

A reported 86% of shoppers check for a return and exchange policy before making a purchase online. So, unless your product can’t be returned safely, it’s smart to accept returns.

A customer-centric policy is one that puts the customer’s needs first at all times. These kinds of policies often offer free return shipping, long request windows, and “100% satisfaction guarantees” that refund their money without even asking why they aren’t happy.

According to a recent study, 62.58% of online customers expect businesses to offer returns within 30 days of purchase.

These types of policies are powerful marketing tools. There’s no doubt they can boost conversion rates because they eliminate a lot of the anxiety that comes with making a purchase.

With all of that being said, don’t feel the need to be overly generous with your refund and return policy just because it’s trendy. Some people will abuse your generosity or look for ways to commit fraud. It’s always important to make the right decision for your business, as opposed to doing what everyone else is doing.

For example, refunds on services are complex cases. You can’t take back a service you’ve already performed. Offering unlimited, no-questions-asked refunds sounds like great customer service, but it also exposes you to fraud that could end up costing a lot of money, especially once word gets around that you’ll essentially work for free.

Return and Refund Fraud and Abuse

When it comes to returns and refunds, there’s actually a lot of abuse. It cost U.S. retailers more than $22 billion in 2022.

Fraudsters try all kinds of tricks. They claim they received incorrect or broken products. They return different products than the ones they received like cheap knockoffs or even just empty boxes. Or, they claim your products or services didn’t meet their standards even when you performed everything you promised.

If these tactics don’t work, many fraudsters stoop to the measure of last resort: the chargeback.

Inappropriate chargebacks are a serious problem. These are cases when the buyer received the product or service as promised, but decided to file a chargeback anyway.

When a buyer files a chargeback, they have to explain why. If the transaction was legitimate, they’ll often make something up to appease the card issuer. Then, you’ll get the opportunity to defend yourself.

This is where your return policy comes into play. It is evidence that the customer was aware of the nature of the transaction before they engaged in it. You get to say, “Hey, Mastercard, here are my refund terms. As you can see, this customer isn’t entitled to a refund.”

Let’s say you provide a digital product for which you charge monthly. You’re happy to cancel plans, but you always prorate the remaining time. You don’t refund for days where the customer had access to the product. So, a customer who cancels on the 25th is still charged for 24 days of the month.

If a customer requests a chargeback because you refuse to refund the entire month, all you have to do is explain to the card issuer that your policy doesn’t offer that type of refund. It also helps to have some type of evidence that the customer was aware of the policy, such as the checkbox at checkout we mentioned earlier.

Of course, a return and refund policy doesn’t mean the card issuer will always be on your side. If your policy has ridiculous or unrealistic terms, the issuing bank will reject your defense. So, try to keep your policy reasonable for your type of business, product, and industry.

Find The Balance With Your Return & Refund Policy

If you’re too generous with your refund and return policy, you’ll open yourself to fraud. If you’re too restrictive, customers will choose other providers. Crafting a great policy, therefore, means finding the balance between providing customers with a good experience and protecting yourself against fraud. Once you decide where you’ll draw that line, make sure to explain it clearly in your written policy.

That’s all! We hope this article has helped you learn how to avoid online payment disputes with a return and refund policy.

If you liked this article, you might also want to check out our guide on how to start your own customer loyalty program.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.