How to Resolve Failed Recurring Payments for Subscriptions (7 Easy Ways)

Last updated on

Feeling frustrated by failed recurring payments on your WordPress website?

If your business offers subscription-based products or services, you’re probably familiar with failed automatic transactions. They’re a reality for any eCommerce or nonprofit website and can lead to involuntary churn.

In this article, we’ll go over why failed automatic recurring payments happen and how you can respond to them to keep growing your business.

In this Article

- Why Do Recurring Payments Fail?

- 4 Common Failed Recurring Payment Scenarios

- How to Respond to Failed Payments

- Step 1: Understand Your Tools

- Step 2: Add Subscription Management to Your Website

- Step 3: Suspend Access or Stop Service

- Step 4: Contact the Customer Manually

- Step 5: Tag the Customer in Your Email Marketing Tool

- Step 6: Send Customized Cancelled Subscription Emails

- Step 7: Implement a Dunning Email Service

- Going Forward

Why Do Recurring Payments Fail?

Before you can address failed payments, it’s helpful to know why they failed in the first place. There are a lot of possible reasons, but here are the main ones:

- Expired card details

- Insufficient funds

- Bank fraud prevention declines to charge

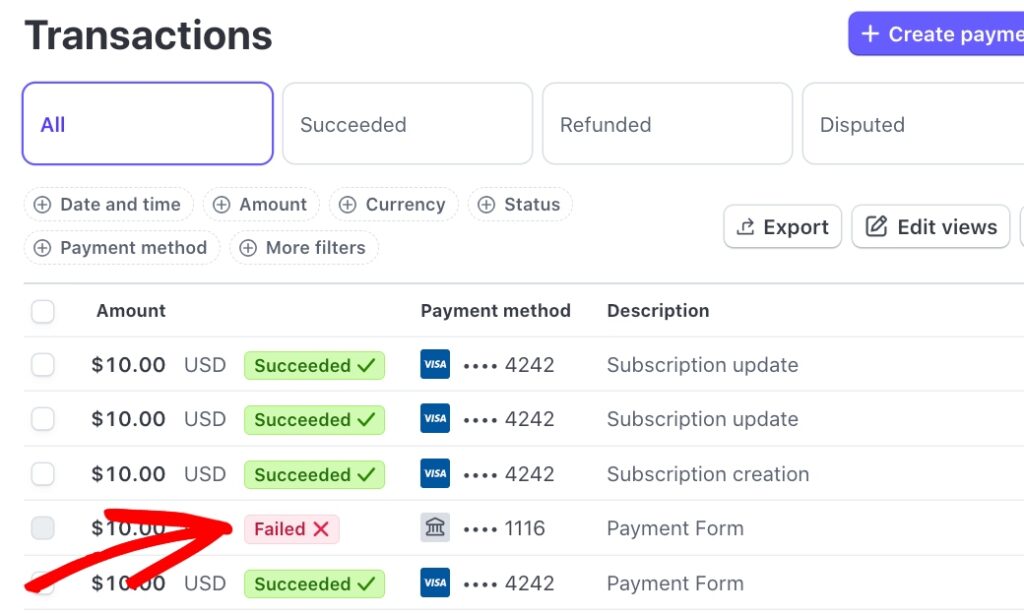

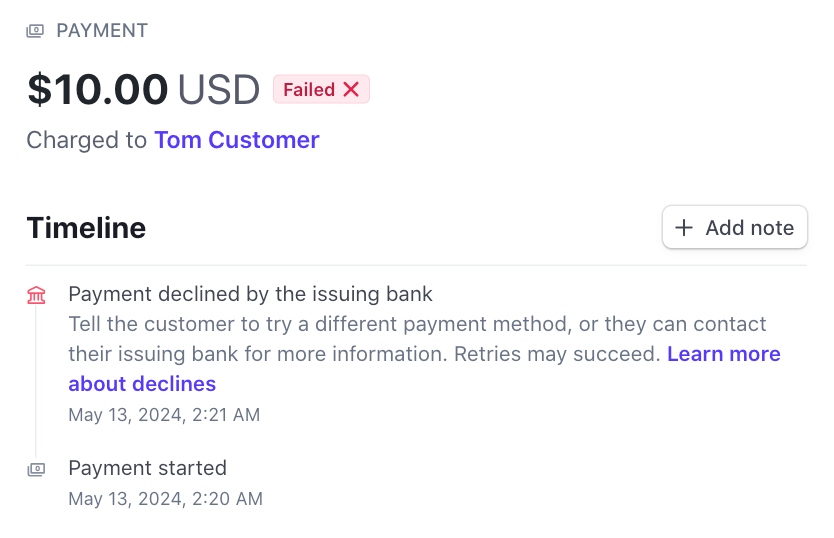

If you’re using Stripe as your payment processor, which we strongly recommend, you can easily access payment reports to look at each transaction to determine why it failed. With less reputable processors, however, you aren’t always given a reason.

The worst type of failed payment is when the customer’s bank refuses to charge. It’s not like you can ask the bank for more information. The only solution is to ask your customer to contact their bank directly, which can be frustrating for everyone.

Fortunately, a failed payment doesn’t mean you don’t get the sale. It can usually be resolved one way or another.

Let’s take a look at four common reasons why subscription payments fail.

4 Common Failed Recurring Payment Scenarios

Before we get into how you can resolve failed recurring payments, let’s go over some of the most common scenarios behind why they happen in the first place.

1. Customers Use Failed Payments to Stop Subscriptions

Oftentimes, customers will tell their bank or credit card company to reject subscription payments. In some cases, they do this because they’re uncomfortable asking you to discontinue their service.

In other cases, they think you’ll ignore their request and keep charging them anyway, as gyms, magazine subscriptions, and some membership sites are notorious for this.

2. Some Subscribers Create a New Subscription

Another scenario is when a customer notices a failed payment but, instead of contacting you or changing their payment details, creates a new subscription.

It’s great that they’re eager to keep using your products or services, but you’ll need to cancel their original membership, or they could be double-charged. As you can imagine, this is difficult to scale, so be prepared to investigate complaints and payment disputes regarding extra charges.

3. Some Subscribers’ Payments Will Fail Every Month

Unfortunately, some people may not have enough money in their accounts to cover the renewal for any number of reasons. You can keep trying each month until it goes through, reach out to them to devise a better system or remove them as subscribers.

4. Many People Feel Embarrassed About Failed Payments

Do your best at trying not to assume people are trying to make your life difficult. Sometimes, the issue is not their fault. Don’t be accusatory when you contact them. Use empathetic language and let them know you aren’t concerned about the reason; you just want to fix it.

How to Respond to Failed Payments

It’s important to have a process in place to respond to failed payments before you get your first one. Once a payment fails, you want to be able to respond quickly to recover the customer. The longer you wait, the less chance you have of retaining that subscription revenue.

Don’t make the assumption that failed payments won’t happen to you. They happen to every business that collects recurring payments.

Step 1: Understand Your Tools

The first thing you should do is discover what features are available to you to investigate failed payments. Poke around your payment processor account, your eCommerce tools, or your payments plugin to learn what’s available. Make sure you understand how these features work. Is there a “notify customer” button? A “retry payment” link? Perhaps an automatic renewal reminder?

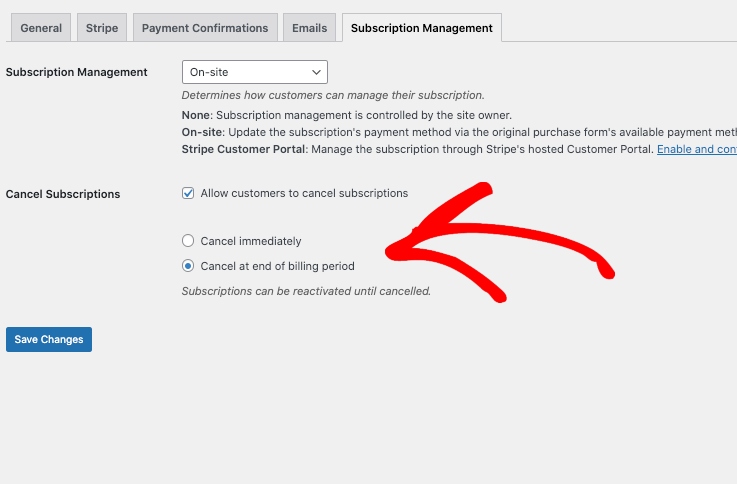

If you’re already using WP Simple Pay to accept payments on your website, you can allow your subscribers to manage their own subscriptions on-site. This is a great way to prevent failed recurring payments because customers can update their payment details and cancel their subscriptions.

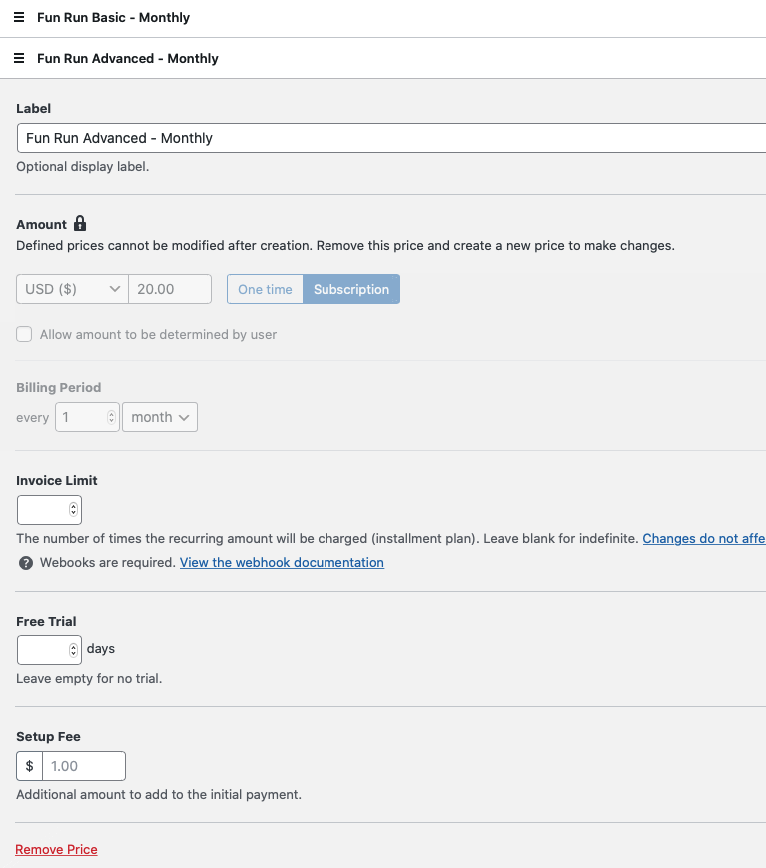

WP Simple Pay also makes it easy for you to set up recurring payment options directly in the payment form builder. You can use the plugin to set the billing periods and invoice limits.

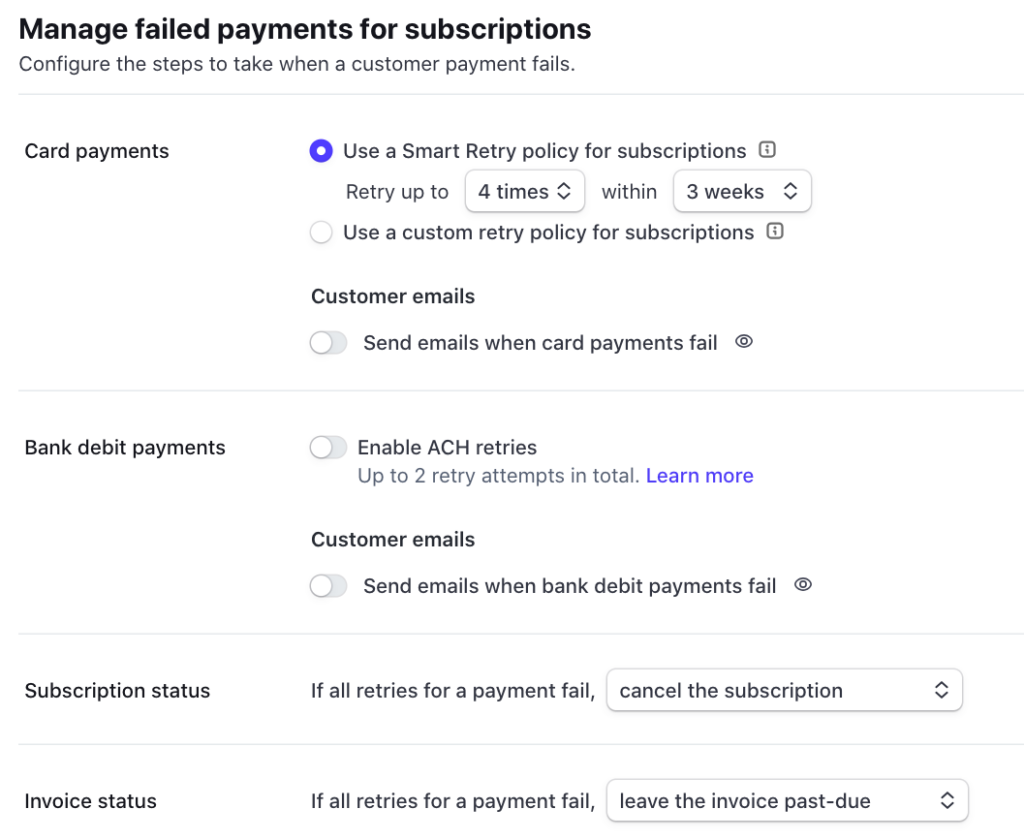

Another great feature of WP Simple Pay is that it is powered by Stripe, which works on your behalf to help recover failed recurring payments automatically by retrying the transaction. If that doesn’t work, it notifies you and the customer about the issue.

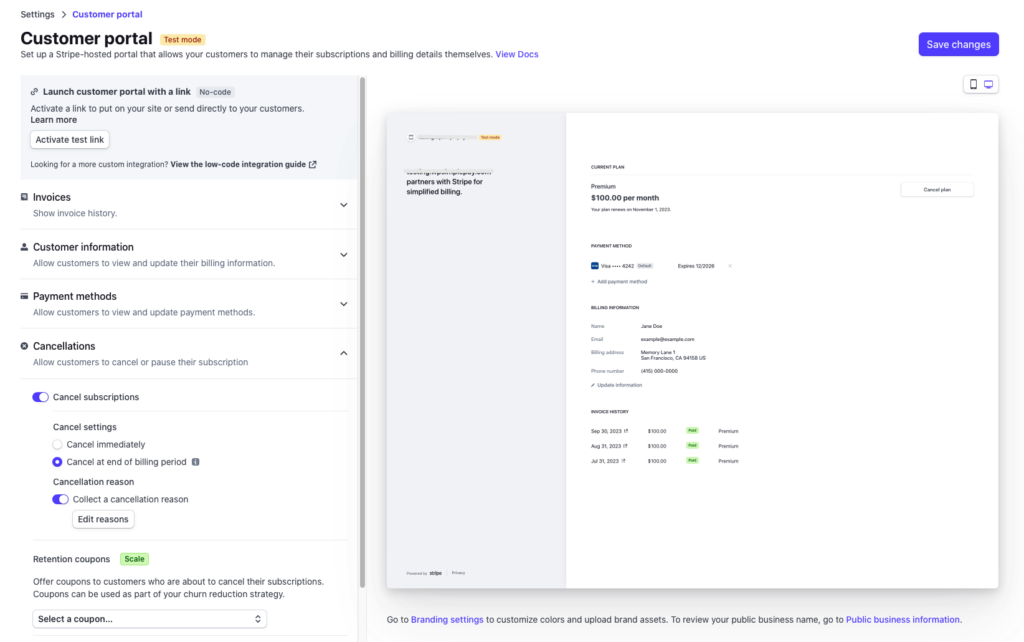

You can easily set up a Customer portal and adjust these settings in the Stripe dashboard.

If your payment tool emails the customer on your behalf, make sure the email includes steps to fix the issue.

“Hey, your card doesn’t work” isn’t enough. The customer needs to be walked through the process of inputting better payment details.

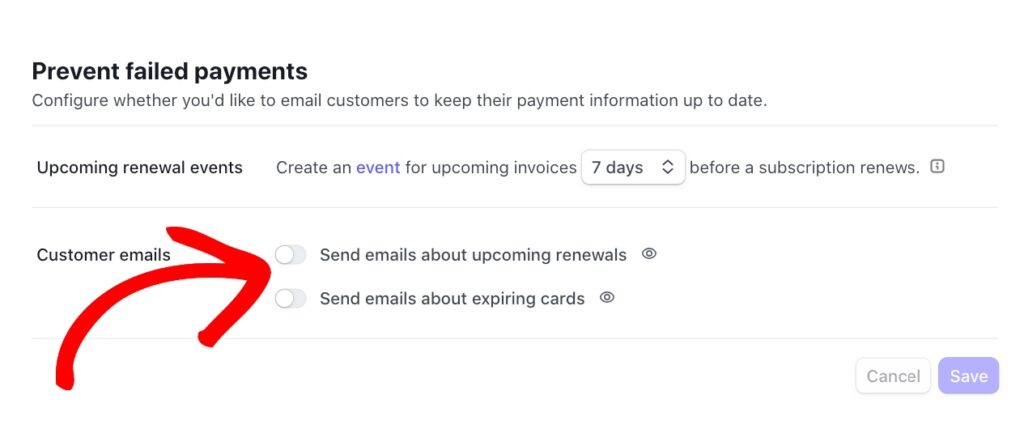

If you’re using WP Simple Pay with Stripe, you can configure whether you’d like to email your subscribers a reminder to keep their payment information up to date before a subscription renews. This gives them an opportunity to update their details before the renewal so a failed transaction never occurs.

Step 2: Add Subscription Management to Your Website

The best way to prevent failed recurring payments is to allow customers to access their accounts at any time.

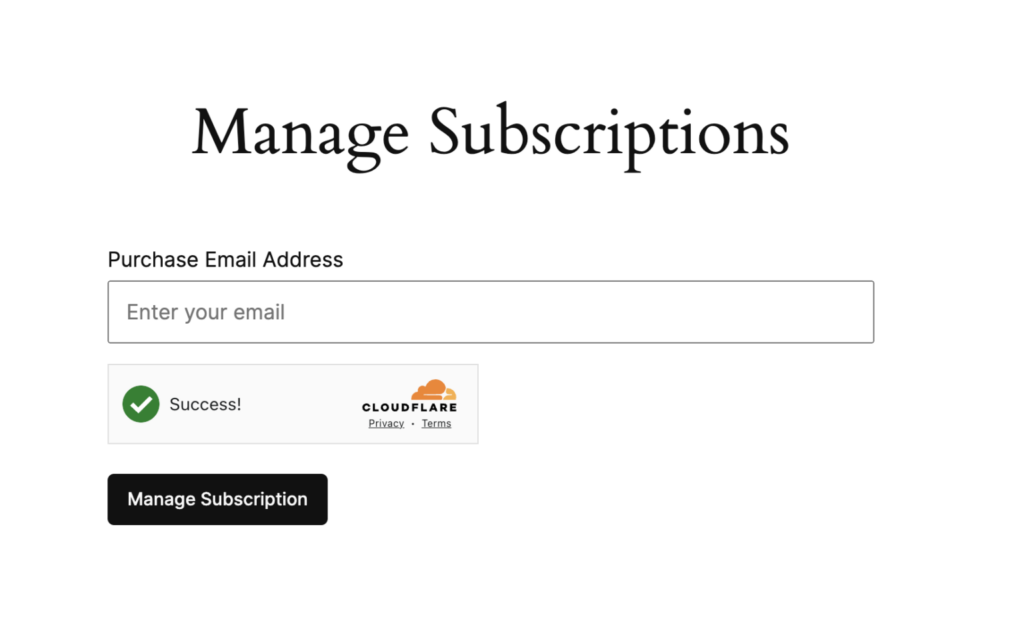

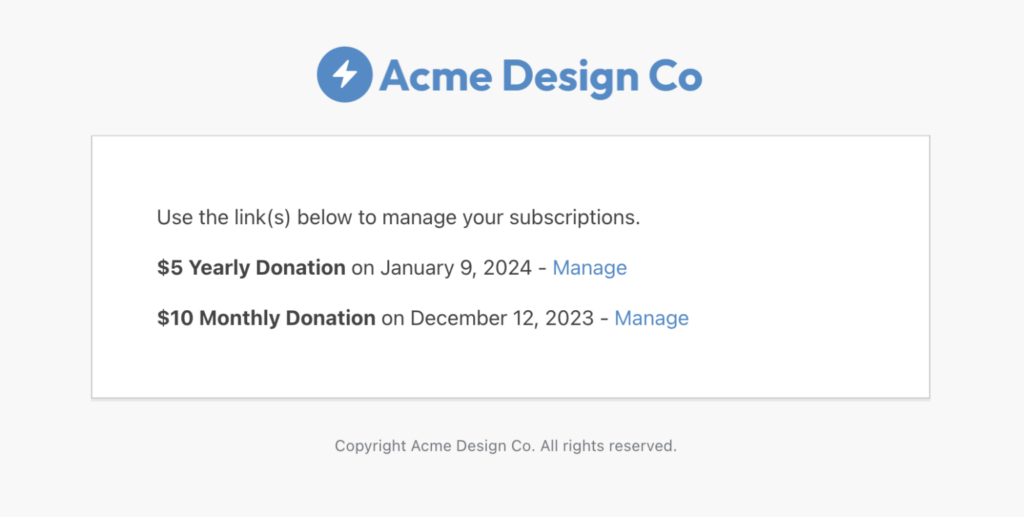

WP Simple Pay allows you to add a Subscription Management form to your website. The form simply requests the account holder’s email address to access the account.

They don’t need to wait to receive their “Upcoming Invoice” email or request it from you to manage their subscriptions.

Once subscribers enter and submit the email address associated with their subscription, they will receive an email with the same links as the “Upcoming Invoice” email.

To learn more, see our step-by-step guide on how to allow customers to manage their subscriptions on WordPress.

Step 3: Suspend Access or Stop Service

While a failed recurring payment is often a simple mistake, that doesn’t mean you should continue to provide access to your products or services during the unpaid period. It’s tempting to give people a grace period for the sake of good customer service, but look out for people who abuse your generosity to get free subscription time.

If the customer’s recurring payments give them access to an application or special content on your website, suspend their account. Redirect them to a page that asks them to update their payment details.

You can easily do this using WP Simple Pay and Stripe. Simply log in to your Stripe dashboard and customize your settings.

If you work as a freelancer or contractor based on recurring payments, stop immediately. Any work you perform after they stop paying could be lost time and money, so wait until you have more information from the customer.

Step 4: Contact the Customer Manually

If your payments tool doesn’t automatically notify the customer, or if you prefer to do it manually, your next step is to send an email.

Without accusing the customer of any wrongdoing, let them know that their most recent payment failed and that you would like to help them fix the problem. This is also a good time to gently remind the customer that you can’t provide a service or access to your products without their recurring payment.

Keep in mind, however, that this method is not sustainable for growing businesses. If you have thousands or tens of thousands of customers, you couldn’t possibly send a manual email for every failed payment. You need an automated solution.

Step 5: Tag the Customer in Your Email Marketing Tool

You’re using email marketing to engage your customers, right? Great!

Even if your payments processor sends an email to the customer, you may want to take additional steps to recover their subscription. It’s a good idea to segment those customers in your email marketing tool, such as Drip or ActiveCampaign, so you can send them special recovery attempt messages.

For instance, you might set up an email sequence like this:

- Email 1: “Hey, just reminding you that your payment failed.”

- Email 2: “Heads up! We’re deleting your account soon.”

- Email 3: “Here’s a discount code if you decide to resubscribe.”

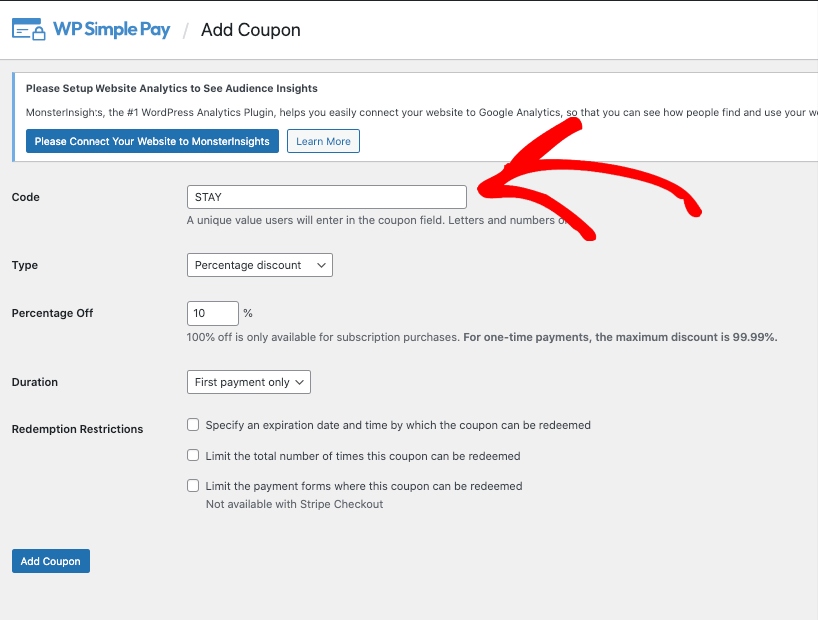

Custom discount codes can be easily created from your WordPress admin dashboard. Simply navigate to the Coupons tab to create the code you’d like to send in your recovery email.

Be sure to create an integration between your payment processor and your email marketing tool. For example, WP Simple Pay has a built-in automation feature that lets you easily connect your Stripe payment forms to several different email marketing platforms directly from the form builder.

Step 6: Send Customized Cancelled Subscription Emails

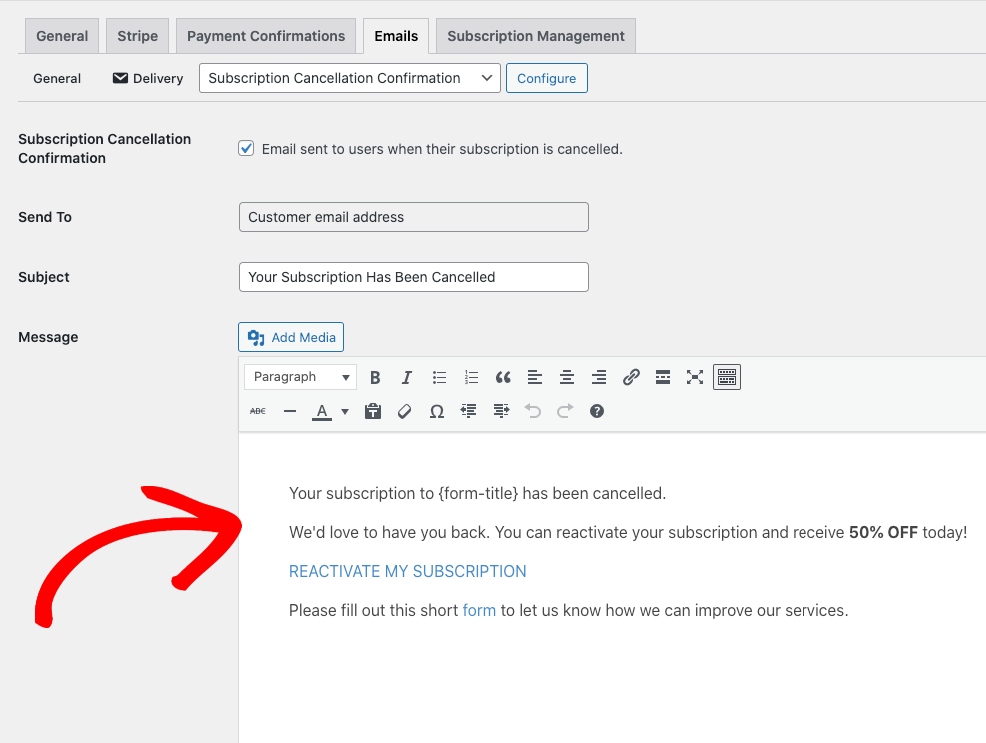

If you have to cancel a customer’s subscription due to failed recurring payment attempts, WP Simple Pay lets you send them a customized “cancelled subscription” email to encourage them to sign back up for your service.

You can even add a custom discount code to encourage them to come back to your business.

Step 7: Implement a Dunning Email Service

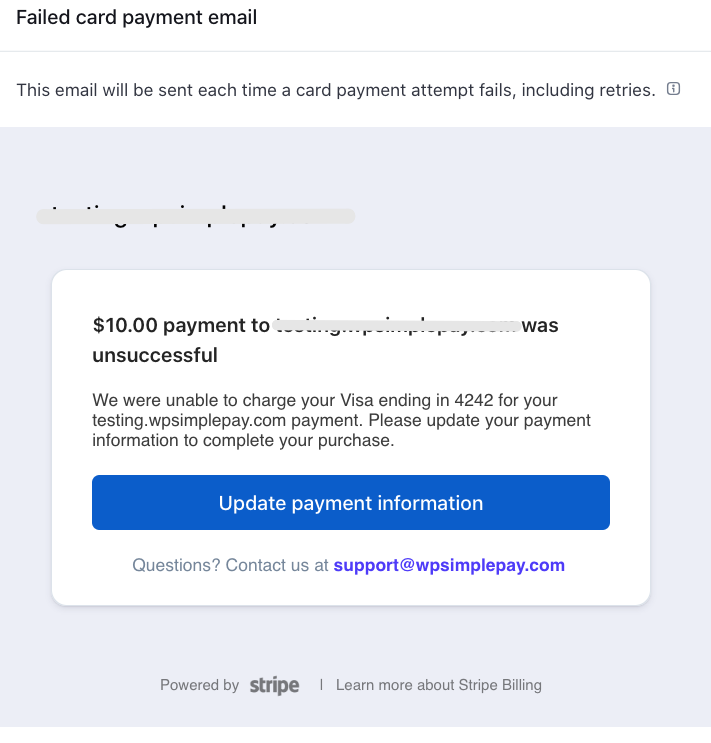

A dunning email is a simple transactional message that notifies the customer about the status of their account and gives them instructions on how to make changes.

In the case of a failed payment, a dunning email would let the customer know that you weren’t able to charge their card, so their service is at risk of being suspended.

Stripe lets you configure your dunning emails directly from your dashboard and set them up to be sent automatically.

Going Forward

Failed recurring payments are only a problem if you don’t do anything to resolve them. Follow the tips we’ve outlined above to address these failed transactions to reduce customer churn.

If you liked this article, you might also want to check out our guide on how to add a setup fee to a subscription plan in WordPress.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.