Stripe: Top Reasons Why It’s The Best Payment Processor in 2025

Last updated on

Are you wanting to accept payments on your WordPress site and wondering if you should use Stripe as your payment processor?

Like most smart businesses, you’ll need to choose a payment processor to collect money easily and securely.

In this article, we’ll share eight reasons why Stripe has become the top choice for both large and small businesses.

Top 8 Reasons Why Stripe Is The Best Processor

Which payment processor is right for your business? Which should you choose?

Without a doubt, Stripe is the best payment processor for most online businesses. It’s especially powerful for early-stage companies that are just beginning to accept online payments. I’ll explain why.

- 1. You Can Set Up A Stripe Account in Seconds

- 2. You Don’t Need a Merchant Account With Stripe

- 3. You Can Accept Recurring Payments With Stripe

- 4. The Pricing Structure is Simple With Stripe

- 5. Stripe Integrates With Hundreds of Products

- 6. You Don’t Have to Worry About PCI Compliance

- 7. The Most User-Friendly Payment Processor

- 8. Accept Multiple Payment Methods With Stripe

- WP Simple Pay + Stripe

1. You Can Set Up A Stripe Account in Seconds

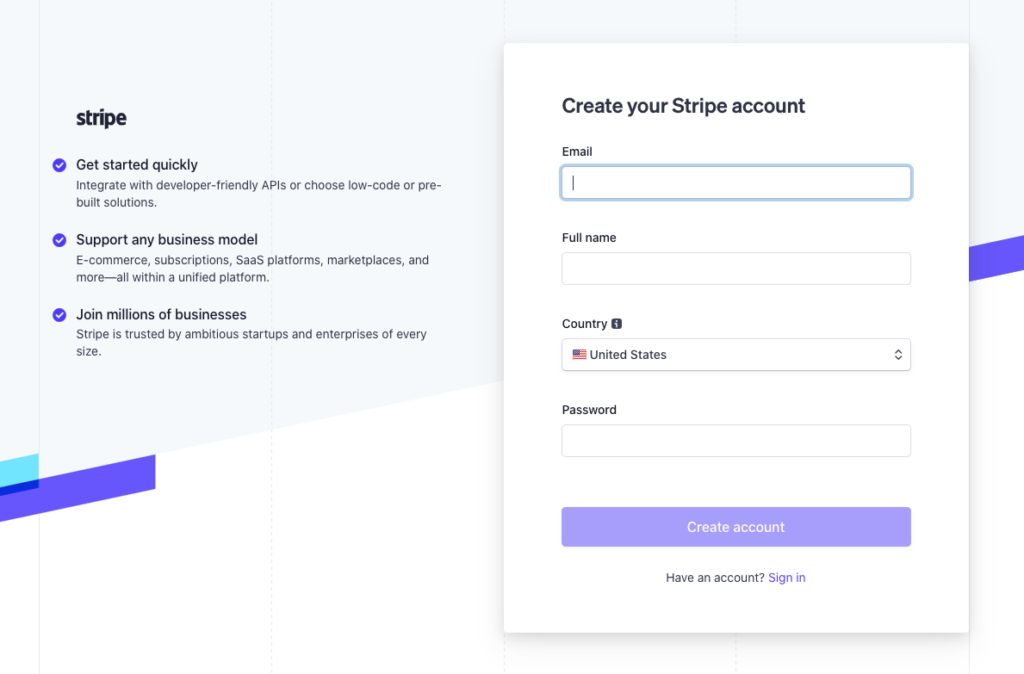

Unlike with other payment processors, setting up a Stripe account is simple. You only need to provide your full name, email, and password to get started.

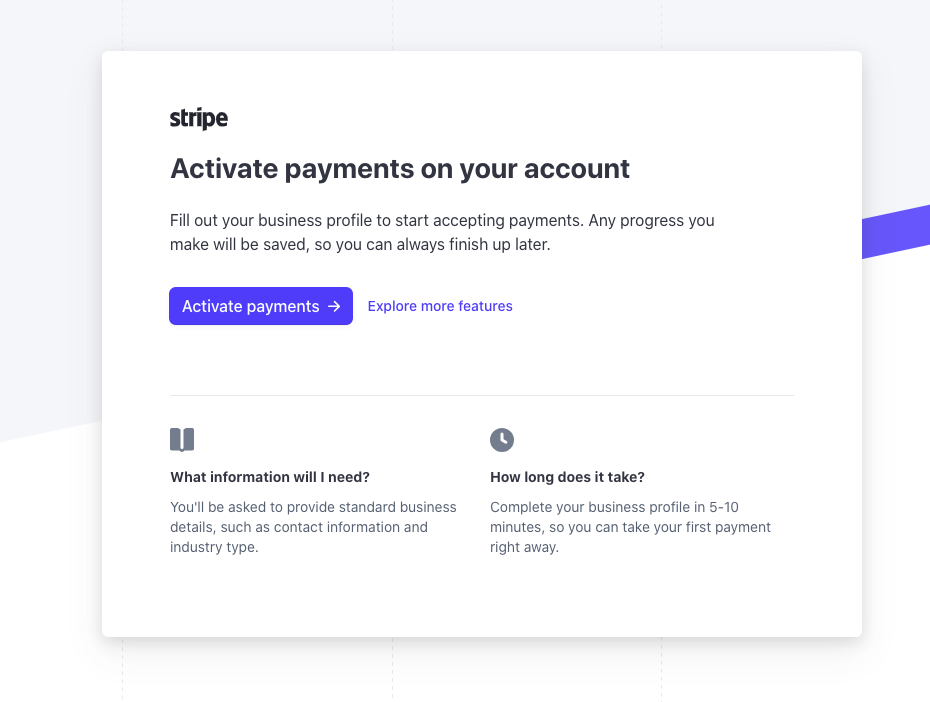

Once your Stripe account has been created, all you need to do is fill out your business profile to begin accepting payments.

Most Stripe accounts are verified within a few minutes, but you’ll find this is quite fast for most payment processors. Stripe may ask for some additional information, but nothing you wouldn’t know off the top of your head.

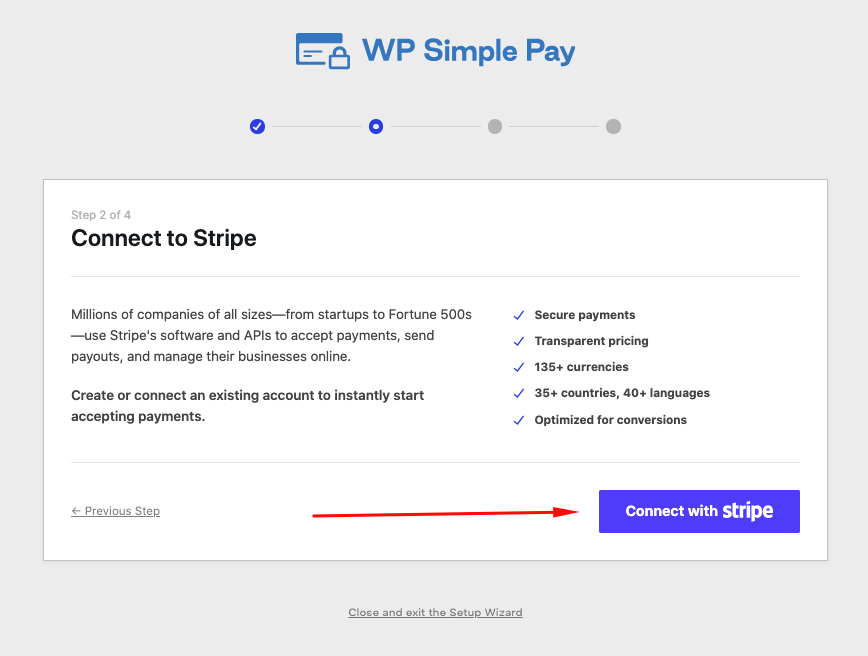

If you’re already using WP Simple Pay, the #1 Stripe payments plugin for WordPress, setting up a new Stripe account is even easier.

The plugin offers a user-friendly Setup Wizard that enables you to create a new Stripe account or connect your existing one without having to enter any API keys.

This allows you to start accepting one-time and recurring payments directly on your WordPress website in minutes.

2. You Don’t Need a Merchant Account With Stripe

Most payment processors require you to open a merchant account at your bank in order to accept online payments. Stripe, however, uses their own merchant account on your behalf. This saves you a lot of time, hassle, paperwork, and a waiting period.

Generally, merchant accounts come with their own set of fees. Stripe wraps it up into their overall cost structure. Even though Stripe’s fees are about equal to other payment processors, they’re actually cheaper once you account for all the services that make up that cost.

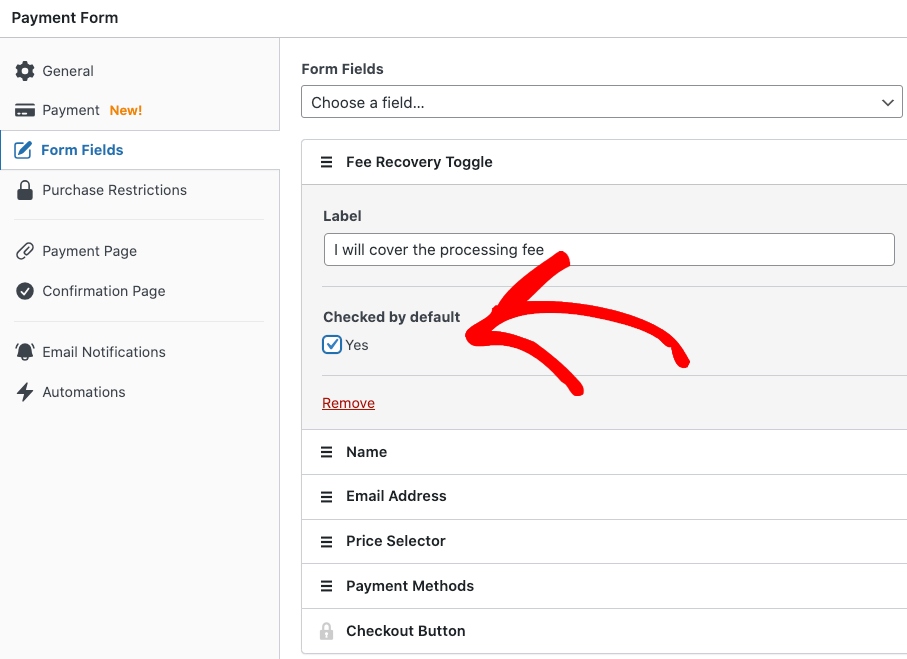

With WP Simple Pay, you can recover the Stripe processing fee by requiring customers or donors to cover it during checkout.

The plugin’s drag-and-drop form builder makes it easy to implement this on your payment forms.

For more information, see our step-by-step guide on how to pass the Stripe processing fee on to your customers in WordPress.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

3. You Can Accept Recurring Payments With Stripe

If your business offers subscription-based products or services, you know how painful it is to invoice your clients or customers every month. Creating invoices and tracking them to make sure you get paid is an unnecessary burden.

With Stripe, you can set up any type of billing model you could possibly need. For example, you can bill at any interval indefinitely, tie your billing to usage, create tiered billing plans, adjust billing for discounts and trials, etc.

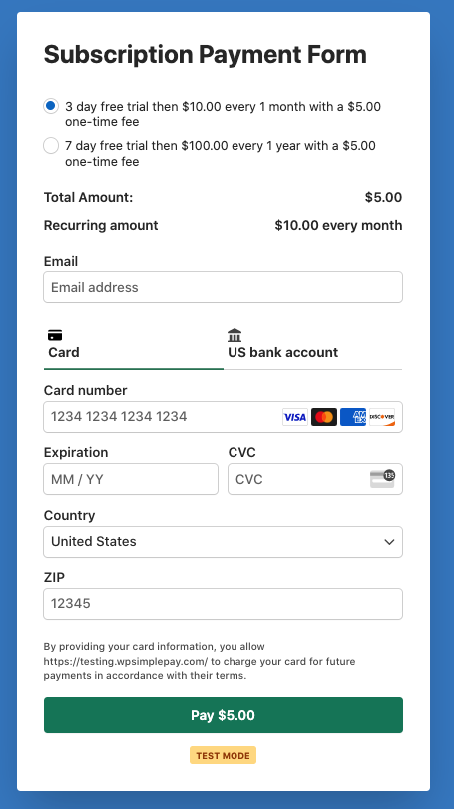

With a standalone Stripe payments plugin like WP Simple Pay, you can set up recurring payments on custom schedules, including every week, month, or year.

You can use the plugin to add subscription setup fees, activation fees, and offer 100% discounts on subscriptions. To help you win back customers, you can even send custom cancelled subscription email messages. The best part? You can do all of this directly from the WordPress admin dashboard.

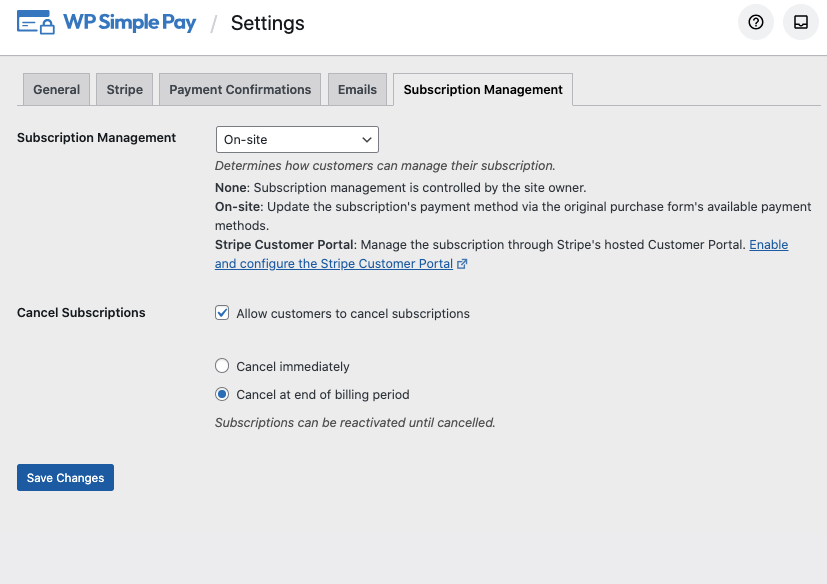

You can even allow your subscribers to manage their own subscriptions and set up an automation that creates a new user account in WordPress after payment has been made. These options are especially helpful for membership sites.

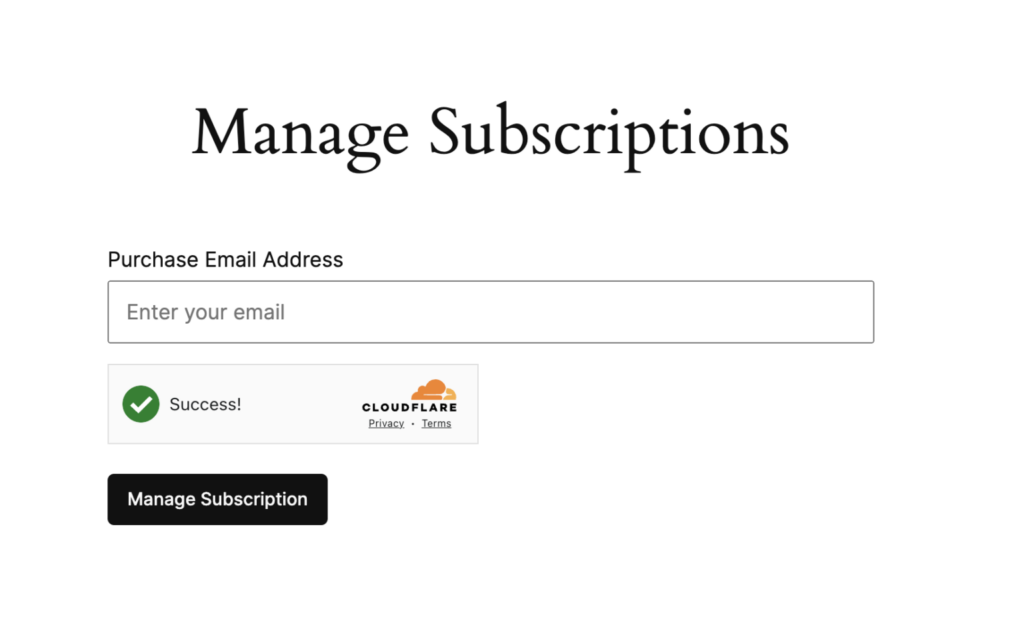

WP Simple Pay also lets you easily add a Subscription Management Block to your website, which lets customers access their account details any time. This is an effective way to prevent subscription churn.

Using the plugin’s drag-and-drop form builder, you can easily create custom subscription payment forms with pre-selected amounts, frequencies, and free trials.

4. The Pricing Structure is Simple With Stripe

Stripe is designed to be simple. Its goal is to make something that’s usually quite complex like accepting online payments into a seamless, easy experience so you can focus on growing your business.

You can see these values reflected in their pricing. For most accounts, there’s only one pricing plan. The payment processor charges 2.9% + 30¢ for each successful transaction. Simple, right?

Technically, Stripe’s pricing structure is actually cheaper than most other payment processors when you consider…

- There are no setup, monthly, or hidden fees. You only pay 2.9% + 30¢ per transaction.

- You only pay for what you use. If you don’t make a sale for three months, you won’t pay anything. Hopefully, that doesn’t happen, but it’s nice to know you won’t be punished for a slow season.

- Stripe deposits to your bank account every business day. However, there’s a two-day delay, so you’ll receive money your customers sent two days ago. That’s far quicker than many processors. Some hold your money for two weeks or only pay once per month.

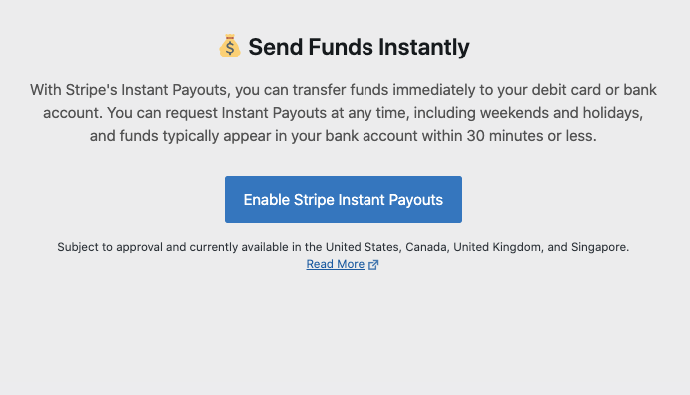

Using WP Simple Pay, you can enable Stripe Instant Payouts, which allows Stripe users in Australia, Canada, Singapore, the United Kingdom, and the United States, to get access to their funds within minutes.

The fee is only 1% of the payout amount for businesses in Canada, the European Union, the United Kingdom, and Singapore. For businesses in the United States and Australia, it is 1.5% of the payout amount.

This simple price structure is the main reason Stripe is a perfect solution for small businesses that are just beginning to accept online payments. You don’t want to commit to monthly fees because you aren’t sure if you’ll make enough to recover the expense.

Plus, Stripe fees only come out when you make money, so there’s no need to pay any bills out of your pocket.

If you do a lot of sales, Stripe has enterprise pricing options as well.

5. Stripe Integrates With Hundreds of Products

As your business grows, you may need to integrate your payment processor with other platforms and tools. For example, at some point you might decide to use a general accounting tool like QuickBooks or Xero to manage your finances, and you’ll want to integrate it with your payment processor.

Most importantly, you’ll want to collect payments right on your website, so your payment processor needs to integrate with your site’s content management system.

If you use WordPress, you’ll want to pair Stripe with WP Simple Pay to accept payments without any coding, techinical skills, or setting up a complicated shopping cart on your site.

Stripe naturally integrates with hundreds of products, including project management tools, ecommerce platforms, accounting tools, analytics platforms, customer relationship tools, and many others. There is an extension for just about everything you need.

If you don’t find the integration you need, Stripe is known as a flexible platform with an accessible API and robust documentation. They even give code samples to make development easy. You won’t have any trouble finding developers with experience building custom Stripe tools.

For more information, see our guide on how to customize & manage Stripe payment reports.

6. You Don’t Have to Worry About PCI Compliance

PCI compliance refers to the Security Standards Council, a forum that organizes security standards for digital payment processing. It’s a set of security standards that govern how you process payments.

PCI compliance isn’t required federally, but some U.S. states require it if you want to sell to their residents. Plus, being PCI compliant looks favorably on you if you ever find yourself in court over a payment-related matter.

If you process debit and credit cards with a merchant account, becoming PCI compliant is an important part of processing payments. It’s also a long process that requires you to take several security steps.

Stripe takes care of this for you. It is a PCI Level 1 Service Provider, which is the most stringent level of certification available in the payments industry.

By transferring payment information through Stripe, the payment processor takes on the obligation of PCI compliance. It uses a unique string of code called a “token” that allows you to bill the card without ever storing the customer’s payment information. Through this method, Stripe saves you the hassle and cost of PCI compliance and improves security.

In addition, if you’re using WP Simple Pay as your Stripe payments plugin, your payment forms are already 3D Secure 2.0-enabled, which is a new tool that makes it easier to stay SCA-compliant.

SCA (Strong Customer Authentication) is a European requirement under the Payment Services Directive 2 that mandates two-factor authentication for card payments in many parts of Europe.

To learn more, see our detailed guide on SCA and how to enable 3D Secure 2.0 in WordPress.

7. The Most User-Friendly Payment Processor

Stripe’s ease of setup, use, pricing, and development make it the most user-friendly payment processors available. It’s far easier to use than its main competitors – PayPal, Authorize.net, or Square.

The dashboard is clean and easy to understand. You don’t need advanced financial knowledge to maneuver around your account and find the information you need. It also provides several custom payment report features that allow you to get an in-depth look into your business without a lot of effort.

From a development standpoint, there’s no easier option. Stripe was originally designed for developers, which explains its immaculate code, accessible API, and thorough documentation. This is how we were able to build such advanced customization into WP Simple Pay.

Most of the features and integrations you’ll need come standard, but if you ever need to hire a developer to build something custom, Stripe’s API accessibility will reduce your development costs.

This makes Stripe the perfect platform for early entrepreneurs who don’t have technical skills. You can accept payments without customizing complex solutions, digging through help documentation, or writing custom code.

8. Accept Multiple Payment Methods With Stripe

Unlike many payment processors, Stripe allows you to accept 10+ payment methods, including traditional credit and debit cards, Apple Pay / Google Pay / Microsoft Pay, Cash App Pay, Alipay, ACH Direct Debit, and more.

It’s no secret that offering your customers or donors their preferred payment method increases conversion rates. If potential buyers cannot purchase your products or services using their favorite, location-based payment method, they will simply find another website that offers it.

To learn more, see our guide on how to accept additional payment methods in Stripe for free using WP Simple Pay.

Additionally, Stripe’s partnership with Klarna lets you offer Buy Now, Pay Later (BNPL) options to your customers instantly. According to Stripe’s research, businesses that implement BNPL options see up to a 14% increase in revenue, driven by improved conversion rates and higher average order values.

In addition to Klarna, WP Simple Pay also lets you offer Afterpay, and Affirm BNPL services.

WP Simple Pay + Stripe

Whether you’re a developer, a web novice, or anywhere in between, Stripe is the best platform to accept online payments and donations on your WordPress website because it’s easy.

Everything about Stripe’s user experience is simple, clear, and straightforward. In the rare event that you need help, Stripe even makes finding answers simple with its search capabilities.

We’re so sure that Stripe is the right choice for online businesses that we built our plugin to integrate your website exclusively with Stripe. It’s just the right choice for businesses who want to collect money quickly without all the hassle.

There you have it! We hope this article has helped you learn more about why Stripe is the best payment processor.

If you liked this article, you might also want to check out WP Simple Pay Review: Is It Worth It In 2025?

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.