How to Manage Stripe Subscription Payments in WordPress

Last updated on

Do you want to offer Stripe subscription payment plans on your WordPress site?

Offering automatic recurring renewals is a great way to save time for both you and your customers. It’s also an effective way to ensure that you maintain monthly recurring revenue.

When handling Stripe subscription payments, you should know a few key things. In this article, we’ll briefly overview how Stripe subscriptions work and share a few tips for managing them in WordPress.

How Stripe Subscriptions Work

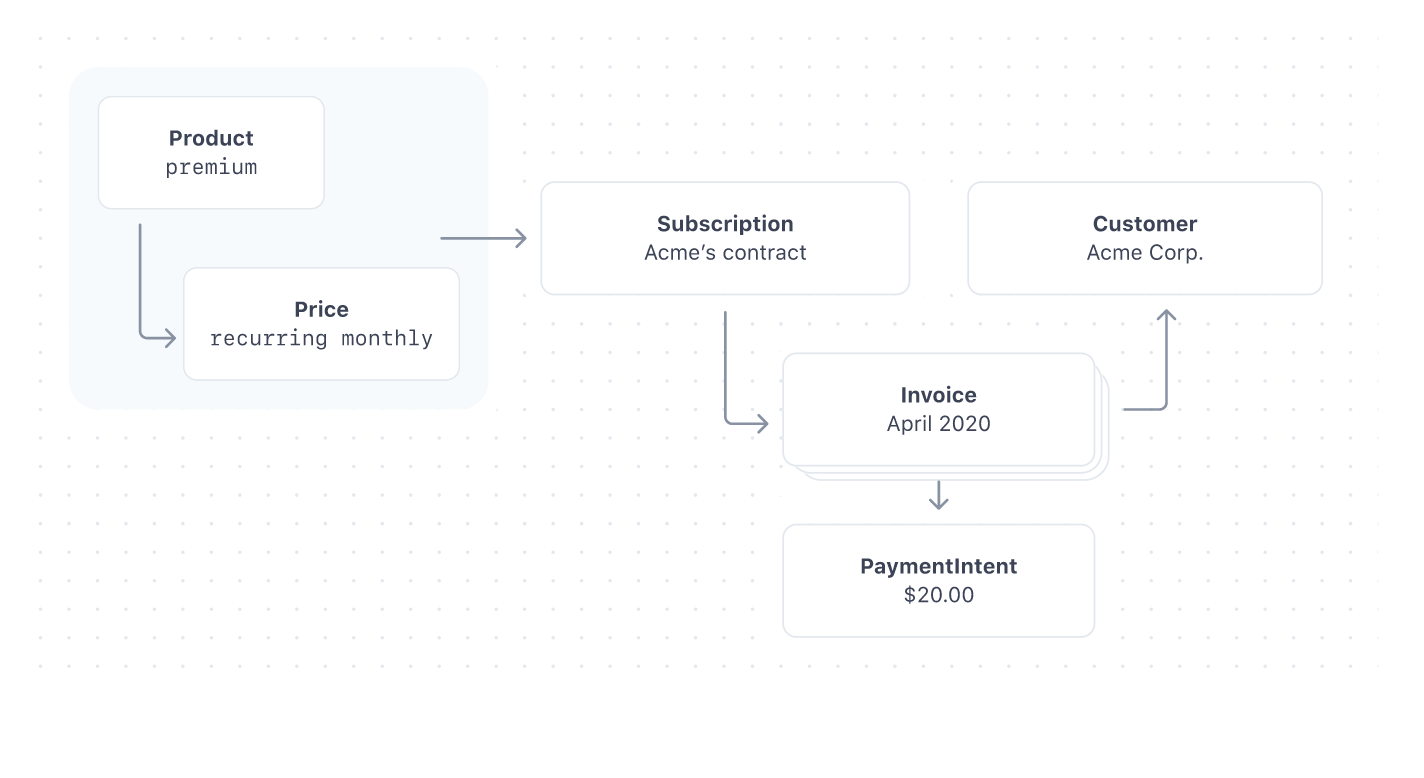

When you want to sell a subscription to a customer, there are four elements involved:

- Customers – This element stores all needed information about your customers, including their email addresses, payment methods, etc.

- Products – The things you sell.

- Prices – The amount customers pay for your products. With subscriptions, Stripe allows you to set different pricing options based on the length of time (annual vs. monthly subscriptions) or the subscription tier.

- Invoices – These are created every time you need to charge a customer for their subscription. The invoice includes a line item breakdown, taxes (if applicable), and total charge amounts.

These elements are all incorporated into the subscription status, which dictates the customer’s access to the product or service. The subscription will not be active without customer information or payment status.

Using the Stripe API, you can integrate these elements into your eCommerce store’s order flow. Most of these details will typically be acquired on checkout pages, but some may come from initial landing pages or account setup pages.

For more information about integrating subscription elements, check out the Stripe documentation overview on subscriptions.

To remove the complexity of using a complicated API, you can create Stripe subscription payment forms directly from your WordPress admin dashboard using WP Simple Pay, the #1 Stripe payments plugin for WordPress.

It offers several pre-built subscription payment form templates to help you create customized subscription forms in minutes without coding. The best part is that you can manage your subscription payment plan settings and elements without logging in to your Stripe dashboard.

Tips to Minimize Subscription Churn

Churn is the enemy of subscription-based businesses. A certain amount of it is unavoidable as people’s financial situations change, or they may lose interest in your product or service.

However, it’s possible to significantly improve your revenue and profits by reducing your churn rate by even a tiny amount.

With this in mind, there are several easy steps you can take to make sure you maintain as much subscription revenue as possible. Let’s take a look.

1. Transparent Billing Cycles

Your subscription billing cycle determines how often your customers are billed for their subscriptions. To reduce churn, you’ll need to communicate billing cycles clearly and promptly so there is no confusion or uncertainty regarding when you will charge your customers’ payment methods for the subscription.

This is a preemptive step, but cutting down on subscription lapses is still essential. If possible, give your customers a few different billing cycle options. It’s common practice among subscription-based businesses to offer a discount for an annual or quarterly billing cycle (as opposed to monthly). Still, depending on your business model, this setup may not be possible.

2. Allow Prorating

What happens if someone wants to sign up for a monthly subscription in the middle of the month? Sure, you can bill them to start their subscription on the first day of the next month, but that’s an inconvenience to the customer as most people expect they’ll be charged for something as soon as they provide their payment information.

The problem worsens if they can’t access their subscription until the first of the following month. Instead, make sure you allow them to make a partial payment towards the prorated amount for the current month, then switch them to a regular monthly payment plan for the following month.

With all that being said, we recommend using a Stripe payments plugin for WordPress that lets you accept subscription payments and allows your customers to access their subscriptions anytime. This reduces lapsed subscriptions because customers can update their payment methods or cancel before the next charge. With WP Simple Pay, you can let customers access their subscriptions directly from your site using a “Manage Subscription” form. To learn more, see our detailed guide on how to allow customers to manage subscriptions in WordPress.

The plugin offers additional subscription features to help you reduce churn, attract customers, and increase subscription signups.

- Free Trials: Use free trial offers for subscriptions to encourage more signups and receive more feedback about your products or services.

- Setup Fees: Charge an initial setup fee on the first subscription payment to cover extra costs you incur. This is perfect for subscription-based businesses that offer customized services.

- 100% Discounts on Subscriptions: Offer 100% discounts on new subscription activations to increase signups and boost sales.

- Renewal Reminders: Automatically send customers renewal reminder emails before they’re charged.

- Invoice Receipts: Send personalized email receipts to subscribers.

Remove the additional 3% fee!

Most Stripe plugins charge an additional 3% fee for EVERY transaction

…not WP Simple Pay Pro!

3. Actively Communicate

Most customers will be relatively forgiving of unexpected issues or situations provided you are prompt and transparent in your communication. As soon as there is a payment issue, subscribers should get an email notification explaining the problem and giving them an easy way to correct it. If there is a date by which their subscription will lapse if they don’t make a payment, be sure to include that information as well.

4. Reiterate the Subscription Benefits

While customers may have previously been aware of the advantages of subscribing to your product or service, they might have forgotten the specific benefits of subscribing.

It’s always helpful to remind customers why they are getting good value from their subscription, especially if it’s been a while since they created their account with you.

Customizing Stripe for Subscription Management

Email and excellent customer service are helpful and can go a long way in reducing subscription churn. On the other hand, to capture more initial subscription business, it’s best to consider how you organize your site’s design and purchase flow, from the initial landing page that customers access through the final confirmation page that lets them know their purchase has gone through successfully.

WP Simple Pay enables you to create a dedicated landing page for subscription payments and custom messages for your payment confirmation page and email confirmation.

There are a few more sophisticated features that you can incorporate using WP Simple Pay to ensure that customers have as many options as possible, such as:

- Custom Payment Amounts: Many subscriptions created by nonprofits and other charitable organizations come in the form of recurring monthly donations. While it’s okay to have standard donation amounts, many subscription donors prefer to enter their own amount to give. With WP Simple Pay, you can easily create subscription payment forms that allow your donors or customers to enter a custom amount.

- Free Trial Periods: Many SaaS companies offer free trial periods from 24 hours to a month. But, to minimize purchase friction, you’ll want to ensure that subscribers automatically get charged when their free trial ends and their paid subscription begins.

- Initial Setup Fees: It’s also relatively common for merchants to charge a one-time setup fee to help cover the costs of onboarding a new customer or earn a bit more revenue from each transaction, depending on the business structure. Reducing or removing initial setup fees can also be a great way to incentivize people to purchase longer subscriptions. For example, if someone pays for an annual plan instead of a monthly one, you might offer to waive their setup fees. This benefits both parties. Customers save money on something they would likely buy anyway, and you get recurring revenue for a more extended period than you might have initially.

- Non-Card Payments. While credit and debit cards are still popular, advancements in technology have seen the rise of alternative digital wallets like Apple Pay and Google Pay. Not only are these much more convenient for most people to make purchases, but they also provide an extra layer of security that gives buyers more confidence, making them more likely to purchase. WP Simple Pay lets you accept multiple non-card payment methods, including Apple Pay / Google Pay / Microsoft Pay, Cash App Pay, Alipay, GrabPay, ACH Direct Debit, Bacs Direct Debit, and more.

That’s it! We hope this article has helped you learn more about managing Stripe subscription payments in WordPress.

If you liked this article, you might also want to check out our guide: Are Subscription Payment Plans Right For Your Business?

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.