Are Subscription Payment Plans Right For Your Business?

Last updated on

Wondering if subscription payment plans are right for your online business?

Invoicing customers for your subscription-based services can be tedious and time-consuming, especially if you charge them weekly or monthly. Like a lot of online businesses with a WordPress site, you’re probably looking for an easier solution to accept recurring payments.

With all that being said, before you begin charging subscription fees for your products or services, it’s important to ensure your online business is ready.

In this article, we’ll share a few key factors you should consider before you start offering recurring subscription payment plans to your customers.

Should You Offer Subscription Payment Plans?

Subscription-based service models are attractive for many reasons. What business wouldn’t want to collect money from the same customers month after month?

However, just because there’s a lot of money to be made with recurring payments doesn’t mean it’s the right path for your business.

You’ll first need to determine if your business model can reasonably charge for a subscription. If your business only offers buy-once products or services, trying to accept a recurring payment wouldn’t make sense.

This doesn’t necessarily mean that you can’t modify your business model. Many eCommerce businesses have evolved over time and thus taken steps to develop their products and services into subscription-based plans that make perfect sense.

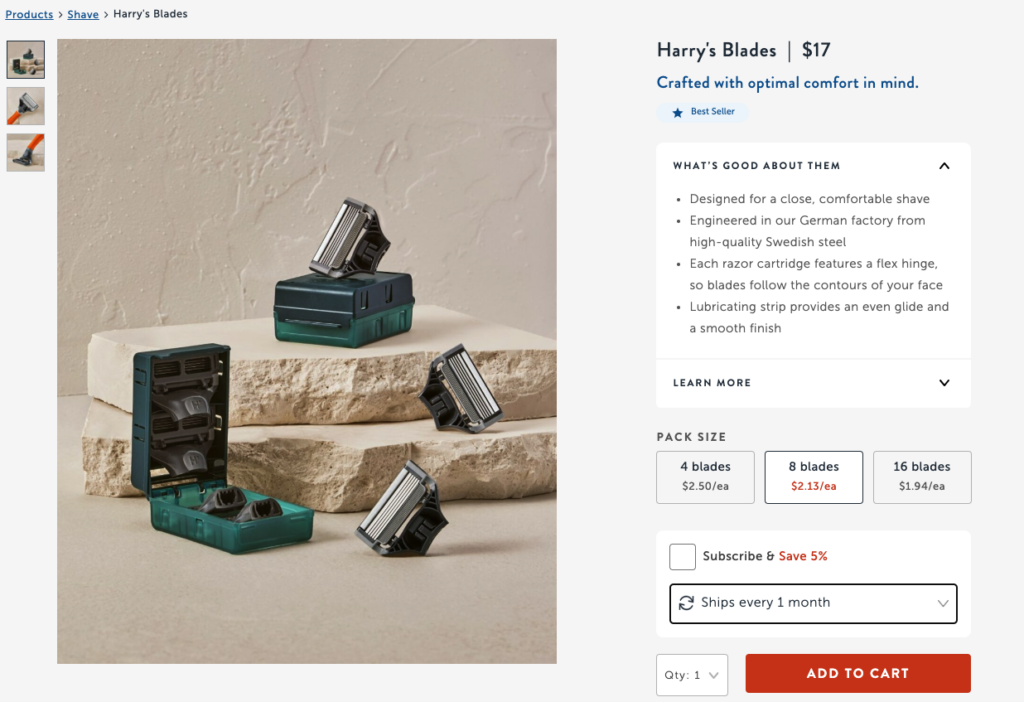

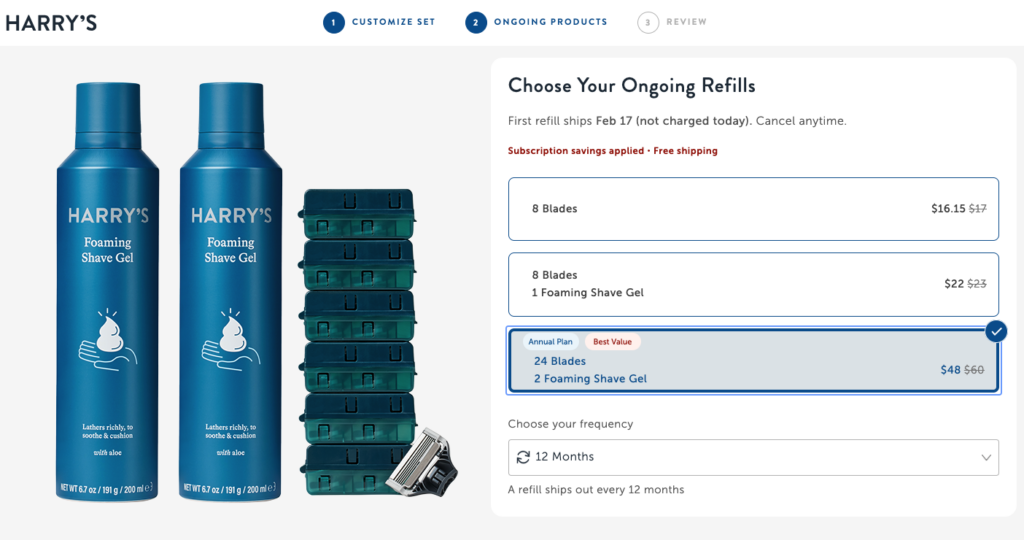

For example, Harry’s Blades sends its members replacement razor cartridges based on a frequency of their choice, from every month to one year. This is a reasonable subscription-based service because razors are disposable, and replacing cartridges from a local brick-and-mortar store gets expensive.

Its business model has also grown its product offerings, resulting in several upsell opportunities by adding additional items to its plans, including shaving gel.

In other cases, it’s reasonable to pay for access to something. You can buy access to a product (like SaaS software), an online community, a physical place, or an online course site.

If your product or service isn’t something people will want to pay for repeatedly, encouraging them to subscribe to a plan is not only a waste of time, but it is also not a sustainable business model that will generate recurring revenue.

Subscription payment plans typically work best for software companies, online courses, and membership sites.

Additionally, charity organizations and nonprofits also make great candidates for recurring payment plans because donors who sign up will give to their causes again and again.

Choosing the Right Payment Processor

To offer subscription plans, you’ll need a payment processor that allows you to automatically accept recurring payments.

Most of the major payment processors let you accept recurring payments, but each one of them handles it differently. Some require a special type of account, while others require additional monthly or per-transaction fees for recurring payments.

Stripe is the best payment processor for subscriptions because it allows any business to accept recurring payments at any frequency without additional costs or integrating other tools.

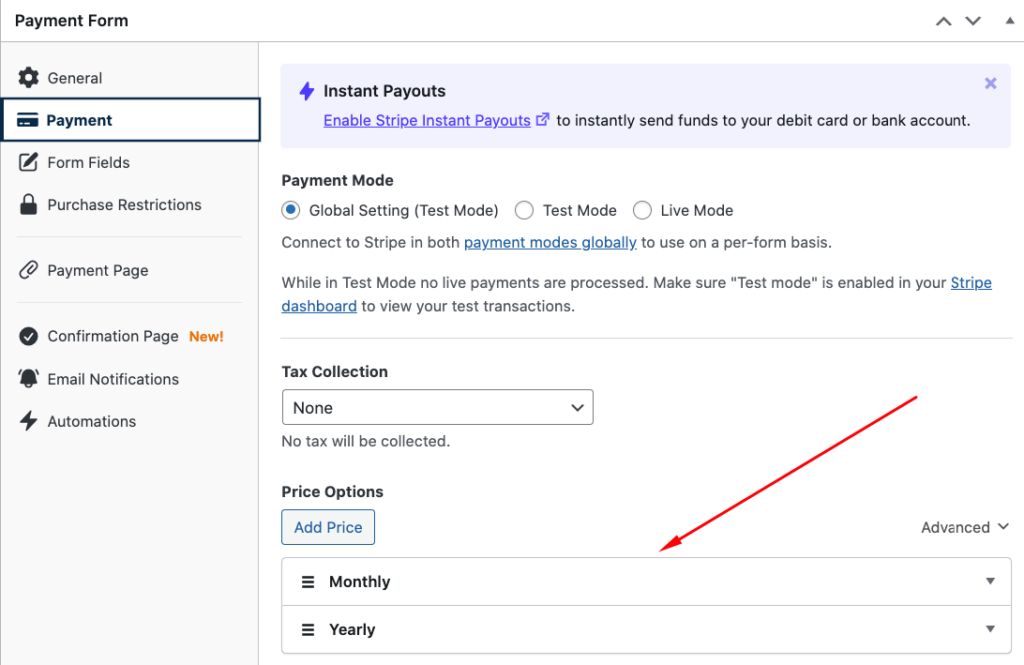

With WP Simple Pay, the #1 Stripe payments plugin for WordPress, you can offer your customers or donors customized subscription payment plans on your site.

The plugin lets you create a subscription payment form using its drag-and-drop form builder. It also offers several pre-built subscription payment forms to help you get started.

You can use the plugin to customize the pricing options and intervals to meet the needs of your business.

By adding checkboxes and dropdowns to your subscription payment forms, you can give your customers or donors a variety of plan options.

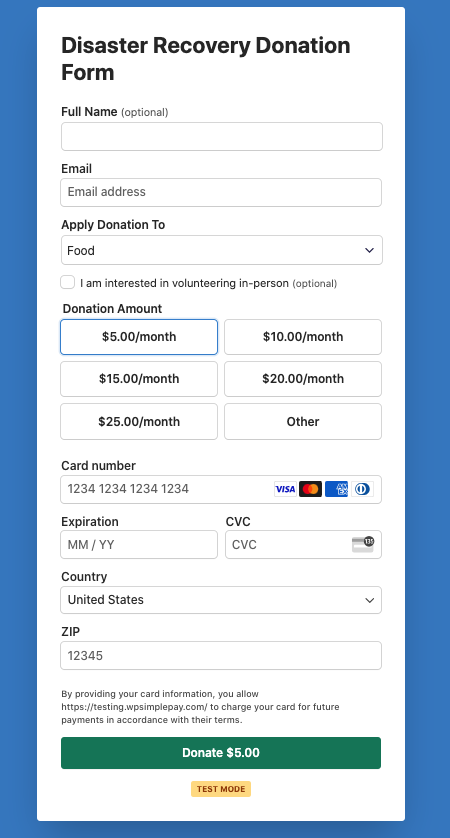

Here’s an example of a subscription payment form for donations. As you can see, donors are presented with several different prices and choices as to where they’d like their donation applied.

Offering Free Trials For Subscriptions

Free trial periods are an important part of offering subscriptions on your site. They can be used to gain feedback about your products, enhance engagement with potential customers, and more.

WP Simple Pay makes it easy to offer a free trial for your subscription-based products and services.

To learn more, see our detailed guide on how to boost subscription signups using free trials.

Pricing Your Subscription Plans Properly?

Before you set up your subscription payment forms, it’s important to understand what you need to charge to cover your costs and make money.

Sadly, many businesses charge too little for their subscription services. They fear customers will balk at high monthly fees, so they lower their prices. Lower prices may convert more customers, but what’s the point if you don’t cover your costs and make a profit?

Pricing your product or service is a complex issue, but there are four main considerations:

1. Your costs. Naturally, your prices should be greater than your costs. Costs include your salary. Factor your time into the equation as if it were an employee’s labor.

2. Your value. Try to quantify what your service does for your customers. If your subscription saves your customer $1,000/month, charging $10/month for it means you’re leaving money on the table.

3. Your competition. While you don’t have to match your pricing to your competitors, and you don’t have to undercut them, it’s helpful to at least know what they charge. If they charge significantly more for the same service, ask yourself if there might be costs you haven’t factored in or if the market is willing to pay more.

4. Your markup. You’re running a business, so don’t be ashamed to price your service above the value of your personal labor costs.

How Will You Manage the Subscriptions?

Be sure to get a clear idea as to how you’ll serve your subscription customers. Here are a few questions to ask yourself:

What will happen if they cancel their service?

What steps will you take when a customer decides to cancel? Will you prorate the service? Refund a portion of it? Refund all of it?

What happens to any data you collect from the customer once they cancel? Do you purge it right away, store it for some time, or keep it forever?

How will you handle billing failures?

Billing failures can occur for several reasons, but usually, they happen because the customer’s card expired or their account lacked enough funds to cover the transaction.

You’ll want a process in place to reach out to the customer for correct billing information. You should also come up with a policy as to how you’ll deliver your service in the event of a billing error. Will you restrict access or stop working?

Can a customer pause a subscription, upgrade/downgrade a subscription, or hold multiple subscriptions?

Depending on the type of business you run and the customers you serve, you may want to give your customers flexible options to manage their services. If so, it’s important to make sure your payment processor gives you control over these options.

WP Simple Pay offers a built-in automation feature that lets you create a new user account for customers in WordPress after payment. This is a great way to give your subscribers access to their accounts.

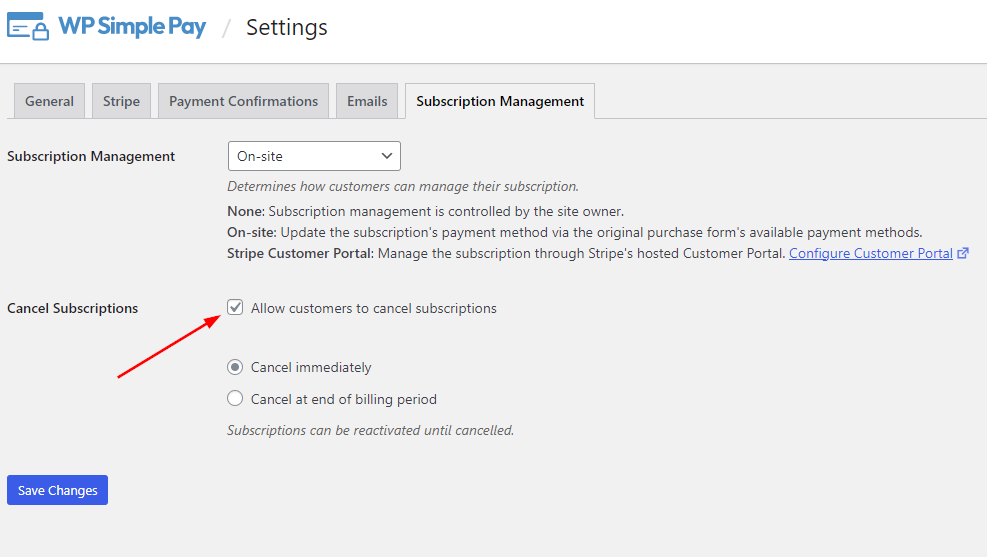

You can also use the plugin to let your customers manage their own subscriptions, helping to reduce subscription churn and retain customers. Setting up this option directly from the WordPress admin dashboard is easy.

How will you deliver your service?

Once you have the customer’s first payment, what steps will you take to deliver the service they purchased?

Will you email them their next steps or instructions to access a members-only site or app?

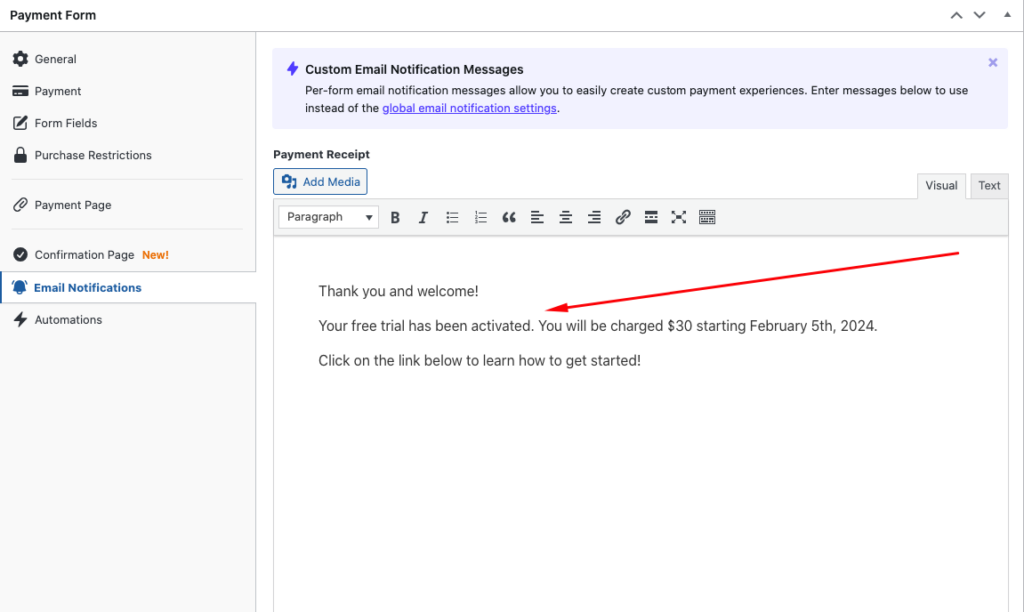

WP Simple Pay lets you customize your subscription confirmation emails and post-purchase confirmation page messages using the form builder. This is a great way to provide them with details about the subscription, and provide them with any required next steps.

How will you keep track of everything?

It’s easy to keep track of your customers if you sell one-off products or services, but things get more complicated when you sell subscriptions, especially if you have a lot of customers.

You’ll need a way to record whether customers are eligible for your service and for how long. You’ll want to know when a customer’s subscription ends so you can restrict access or stop your service and/or reach out to the customer for a possible renewal.

An easy way to keep track of your customer data is by linking your payment forms with a Google Sheet. With WP Simple Pay, you can have new subscribers automatically added to a Google Sheet and even your Drip, ActiveCampaign, or MailChimp mailing list.

How will you report on your performance?

Lastly, you’ll need a way to report on the performance of your service.

How much revenue do you generate? What percentage of customers churn? What’s your customer acquisition cost? What’s the lifetime value of each customer? Are you absolutely sure your subscription service is profitable?

These are essential data points you can’t run a business without. They help you make smart decisions to run and grow your business.

There you have it! We hope this article has helped you determine if subscriptions are right for your business.

If you liked this article, you might also want to check out the following guide: 6 Tips to Boost Subscription Signups With Free Trial Offers.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on Twitter.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.