7 Reasons Why You Should Accept Digital Wallet Payments

Last updated on

Are you wondering why you should accept digital wallet payments, including Apple Pay / Google Pay / Microsoft Pay, Cash App Pay, Alipay, and more on your WordPress site?

Not only does accepting digital wallet payments help globalize your business, it also aids in increasing conversion rates by offering your customers their preferred payment method.

In this article, we’ll share the top reasons why you should accept digital wallet payments.

Table of Contents

- What are Digital Wallets?

- Why Should You Accept Digital Wallet Payments?

- 1. Digital Wallet Payments Are Fast and Convenient

- 2. Digital Wallet Payments Are Secure

- 3. Accepting Digital Wallet Payments Is Simple and Easy

- 4. Digital Wallets Work In-Person

- 5. People Trust Apple, Google, and Microsoft

- 6. Accepting Digital Wallet Payments Boosts Conversions

- 7. Accepting Digital Wallet Payments Doesn’t Cost More

- Accepting Digital Wallets With WP Simple Pay

What are Digital Wallets?

Digital wallets are financial apps that allow users to store their debit cards and credit cards on their computers and mobile devices. They can then use their devices to make contactless electronic transactions without using a physical card.

Some of the most popular digital wallets include Apple Pay, Google Pay, Microsoft Pay, Cash App, Alipay, and GrabPay.

With digital wallets, users can make both online and in-person purchases. The wallet instantly transmits payment information to point-of-sale devices located in stores or auto-populates payment fields on eCommerce sites.

Why Should You Accept Digital Wallet Payments?

If you don’t let your customers or donors pay using their preferred digital wallet, you’ll undoubtedly lose sales and potential business.

Let’s go over the top reasons why you should begin accepting digital wallet payments on your WordPress site as soon as possible.

1. Digital Wallet Payments Are Fast and Convenient

Surely, you know the importance of making online transactions as simple and painless as possible for your customers. Your goal should be to streamline your payment process, reduce friction, and remove any obstacles between your customers and making purchases.

Digital wallets are fast and convenient for your customers. Their device will load all of their payment information so they can make purchases with a single click of a button.

It also means they don’t need to find their credit cards when they want to make a purchase. They can purchase from you the moment they’re in the mood without needing to hunt down their wallet in the other room or bookmark your page so they can pay later.

2. Digital Wallet Payments Are Secure

Customers and clients care about data security and privacy more than ever before. Their fears are valid, of course, considering how often we learn about major data breaches. Even though they know that they can initiate a chargeback for fraudulent charges, they still don’t want to deal with the hassle.

While no payment system is completely immune to fraud, digital wallets are just as secure as any other payment method. Payment data is stored encrypted on your customers’ devices. Encryption changes constantly, so it’s nearly impossible for fraudsters to intercept and use the data maliciously.

Plus, digital wallets offer an additional layer of fraud protection because there’s no need for your customers to pull out their credit cards. If they ever lose possession of their device, they can simply lock their digital wallet from any other computer or device.

3. Accepting Digital Wallet Payments Is Simple and Easy

Unlike with many other technologies, accepting digital wallet payments is quite easy, even for small businesses without many resources. You don’t need expensive plugins or pricey custom development.

In fact, most payment processors and point-of-sale systems already offer support for digital wallets. For example, if you use Stripe as your payment processor, you already have all the functionality you need to accept payments through Apple Pay, Google Pay, and Microsoft Pay on your site.

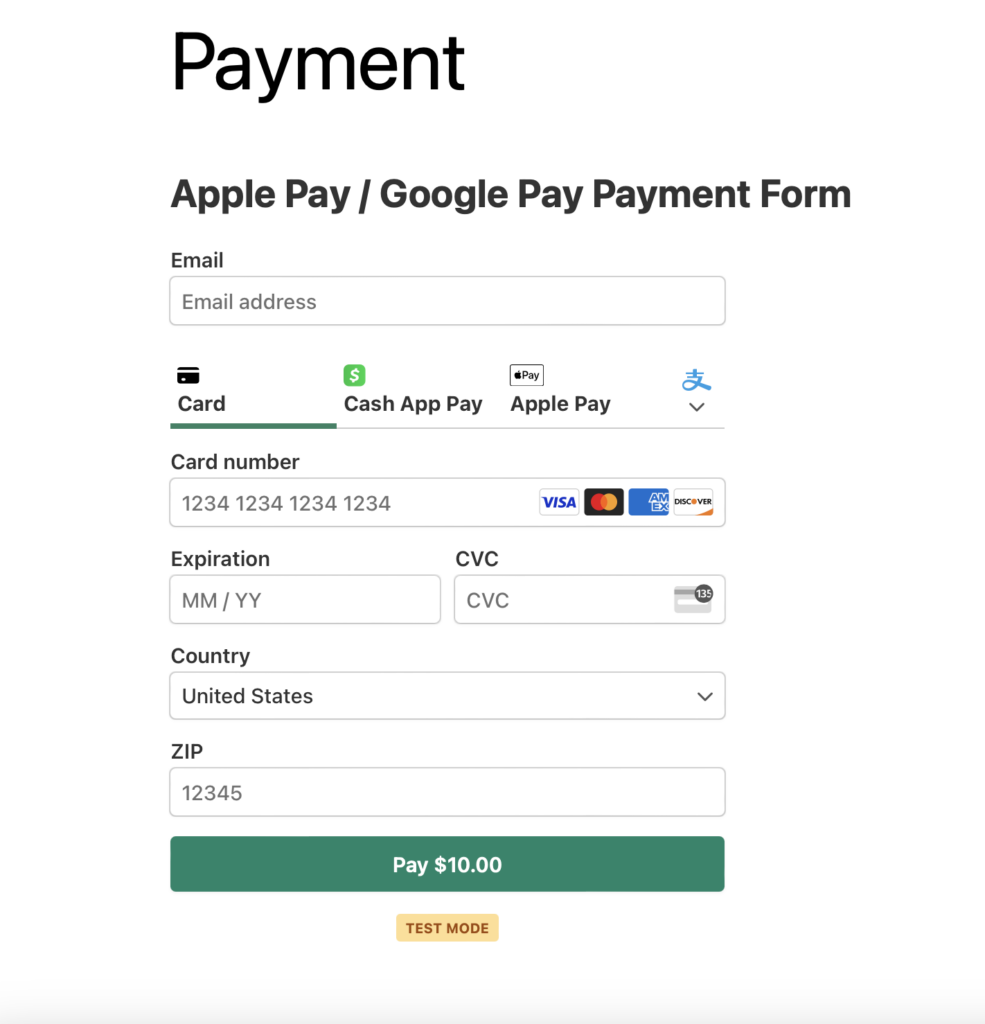

If you’re using WP Simple Pay, the best Stripe payments plugin for WordPress, to accept payments on your site, you can easily create payment forms that accept Apple Pay, Google Pay, and Microsoft Pay without a single line of code. The plugin also lets you accept Cash App Pay and Alipay.

4. Digital Wallets Work In-Person

If you take payments in person, you’ll love the convenience of digital wallets. With the help of a technology called Near Field Communication, you can take your customers’ payments by simply having them hold their smartphones near your sales terminal. Their phone never leaves their hands and the transaction only takes about six seconds.

Why is this good for your business? Because it takes the focus off the payment side of the transaction. Instead of sliding cards, entering pins, or signing receipts, the “down to business” side of the transaction is over before you know it.

This lets you focus on delivering value to your customer and making them feel comfortable with their transaction. It also keeps things moving efficiently, allowing you to move on to the next sale.

5. People Trust Apple, Google, and Microsoft

While your business might not be small, chances are it isn’t as big or as well-known as Google, Apple, and Microsoft. Most of us interact with these businesses every day. We buy their products, visit their apps and sites, and make plenty of purchases from them.

Over time, we begin to trust these companies with our data, especially our payment information. They make too much money to risk it all by stealing a few hundred bucks from one of their customers, and it’s in their best interest to keep your data safe so you continue making purchases from them.

This means your customers probably trust these companies a lot more than they trust your business. It’s not that they find you untrustworthy, it’s just that when it comes to sensitive data, we generally tend to stick with what we know.

So, by leveraging these companies’ brands, you’ll capitalize on all the trust they’ve established over the years. Eventually, your customers will grow to recognize your business as trustworthy, but until then it’s smart to ride on the coattails of Apple, Google, and Microsoft.

6. Accepting Digital Wallet Payments Boosts Conversions

Increasing conversions is the most compelling reason you should let your customers pay using their preferred digital wallets.

Digital wallets were used for 49% of all global online purchases in 2022, while 20% of purchases were made using credit cards. This means that nearly half of all online purchases were made using digital wallets.

Allowing your customers to use their location-based digital wallets helps expand your business internationally and ensures that you’re catering to a much broader customer base.

7. Accepting Digital Wallet Payments Doesn’t Cost More

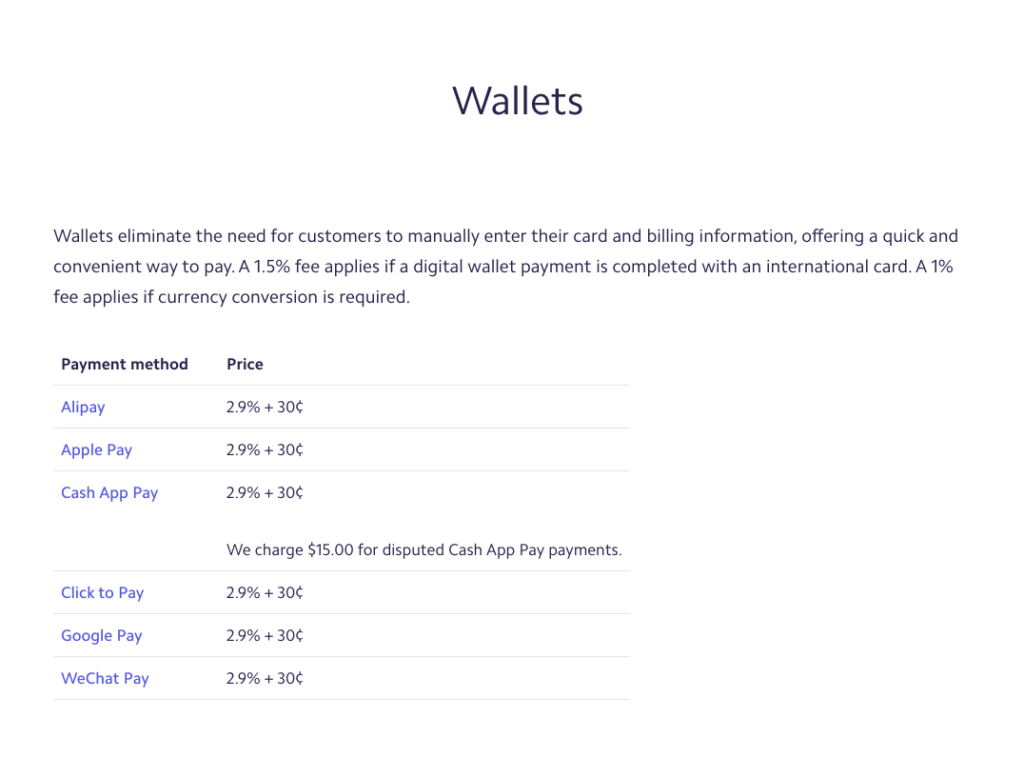

Like with traditional online card payments, Stripe charges 2.9% + $0.30 for digital wallet payments. A 1.5% fee applies for both digital wallet payments and card payments if they’re made with an international card.

So, if you’ve been waiting to accept digital wallets on your site for fear of higher fees, rest assured the transaction fee is the same as credit and debit cards.

If you’re using WP Simple Pay to accept payments, you can even remove the additional processing fee by passing it on to your customers or donors.

See our full guide on how to receive the full net amount by removing the additional Stripe fee.

Accepting Digital Wallets With WP Simple Pay

The best way to accept digital wallet payments on your WordPress site is to use WP Simple Pay.

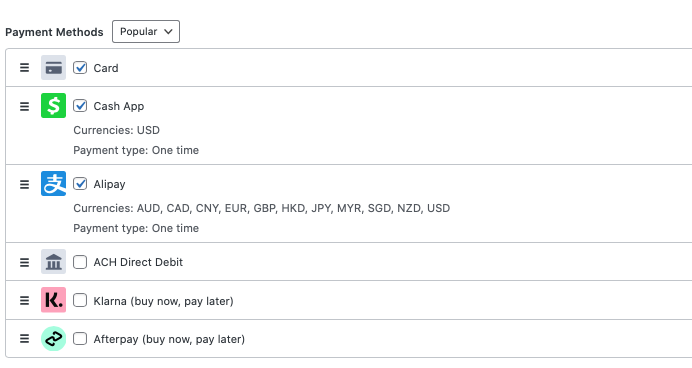

The plugin makes it easy to add Apple Pay, Google Pay, Microsoft Pay, Alipay, Cash App Pay, and GrabPay to your payment forms from the drag-and-drop form builder.

When you add a digital wallet payment method option to your payment form, any visitor with a browser and device combination that allows one of these options will see an additional payment button on the payment form.

Here’s what that looks like to your customers. All they have to do to pay is click that button to complete their purchase.

There you have it! We hope this article has inspired you to accept digital wallet payments on your site.

If you liked this article, you might also want to check out our guide on how to accept ACH payments in WordPress.

What are you waiting for? Get started with WP Simple Pay today!

To read more articles like this, follow us on X.

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.