How to Collect Those Unpaid Invoices

Last updated on

In a perfect world, your clients would pay you the moment they receive your invoice. Sadly, it’s never that simple. You’ve probably had your fair share of clients who delay sending payment or don’t pay at all.

Unpaid invoices aren’t just an inconvenience. They cost time and money. They create stress in your life. They take time away from serving your clients and improving your business. Worse – they create cash flow problems that can affect your operations, especially if you have significant expenses, like leases or employee salaries.

17 Ways to Collect Your Unpaid Invoices

If you’re struggling to get paid, these tips will help you plan a course of action. They become more aggressive as you go through the list, so start at the top and work your way down.

1. Start with a Friendly Reminder

Most clients are honest people who intend to pay their bills. It’s more likely that your client forgot to pay the invoice or ran into unexpected money problems than that they intentionally tried to steal products and services from you. Your first step, therefore, is to give them a little nudge.

Send your client a message seven days after the invoice’s due date. Remind them to pay in a friendly and gentle way. Don’t complain or imply that they are dishonest. Include all of the payment details and attach a copy of the invoice.

2. Keep Good Records

You should have copies of your invoices on file (or in whichever software tool you use to generate them). Do not delete them. Furthermore, document every attempt to communicate with your clients about their balance. This keeps you prepared if you have to go before an arbitration board or small claims court. In fact, if you spend a lot of time trying to collect, you may be able to get compensation for those hours.

3. Keep Your Emotions in Check

Your business is personal to you, so when a client refuses to pay, it’s easy to let your emotions take control. But that never helps. In fact, an overly emotional response could be enough for your client to decide to just ignore you.

Don’t let your anger or frustration show in your email and phone conversations. Avoid tears, raising your voice, or making threats. Stay professional at all times.

4. Enforce Your Late Payment Fee

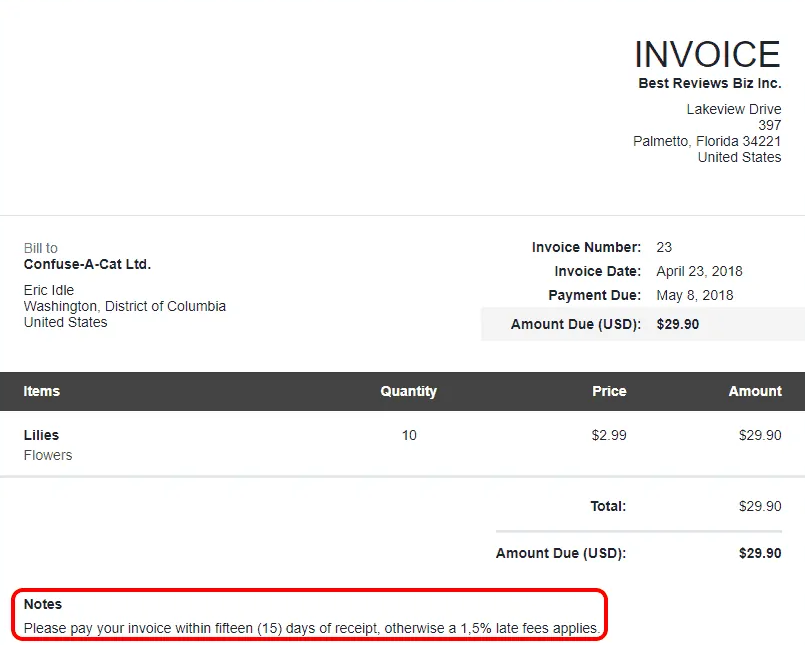

If your payment terms include a late payment fee if invoices aren’t paid after a certain date, it’s time to enforce them. Send an email to the client with an updated invoice. On the new invoice, add your late payment fee.

If you don’t have a late payment fee in your payment terms, it’s unethical to add one after the fact. But now is a good time to amend your payment terms for future clients. Include a late payment fee that’s a percentage of the balance (like 2% or 3%) and increases each month the invoice is unpaid.

6. Mark Your Invoices “Overdue”

Resending the same invoice over and over may not get anyone’s attention. Add some urgency language like “Overdue,” “Past Due,” or “30 Days Late” to the invoice, the envelope if you mail it, or the subject of the email if you email it. Use a bright, contrasting color.

7. Make a Phone Call

A phone call is more intimate than an email. It forces the client to speak to the real person they’re hurting by not paying their bill. This also gives you the opportunity to ask why the payment is late and when you can expect it. You may be willing to customize your payment terms depending on their problems and timelines.

8. Allow Partial Payments

If your client doesn’t have the full balance of your invoice, ask them to pay a portion of it now and a portion later. It’s better to get some money than to wait around for the full invoice. Consider splitting the bill into multiple installments until the balance is paid.

Plus, getting your client to pay something makes it harder for them to deny the invoice in court if you ever have to sue them. A judge will ask, “If the invoice is invalid, why did you make a payment?”

9. Accept Credit Card Payments

If your clients typically pay by cash or check, you’ll want to let them pay with a credit card. This payment method gets you paid and makes the debt the credit card company’s problem.

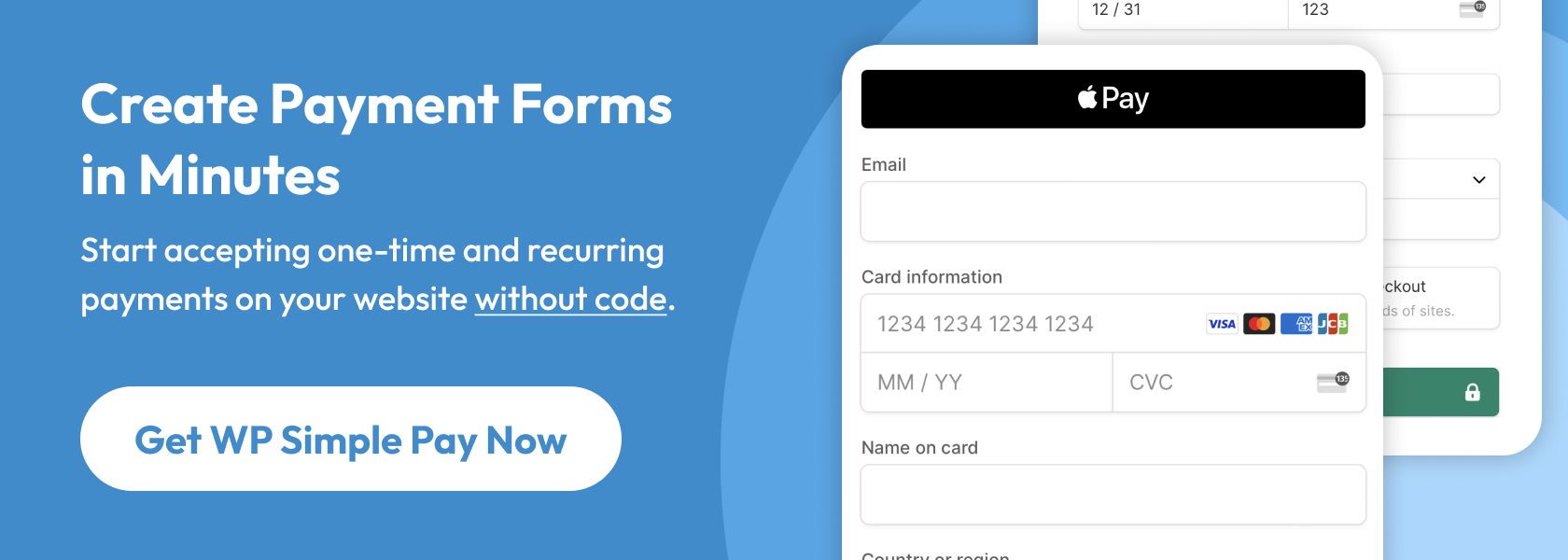

Fortunately, you don’t need your own merchant agreement or a complex ecommerce platform to accept credit cards. With a simple tool like WP Simple Pay, you can create custom payment forms for clients to pay with their card. They can even use modern payment wallets like Apple Pay and Google Pay.

Whether or not you’re using WP Simple Pay, you can create individual one-time or recurring invoices in your Stripe dashboard to send to your clients and customers. These invoices are hosted entirely on Stripe’s servers. Check out our guide on creating invoices in Stripe.

Yes, credit cards come with a small fee. You can pass this fee along to your clients or just eat the cost yourself. It’s better than not getting paid.

10. Discontinue Your Services

If your clients owe several invoices and you’ve had no luck getting them to pay, it’s time to cut them off. If your offerings are vital to their operations, they’ll find a way to catch up with their bills. If they don’t need you badly enough to pay, at least you won’t spend any more money providing services.

That said, use your best judgment here. If the client needs your services to make money to pay you, it may make sense to continue working.

11. Bypass Your Contact

If your client works at a multi-employee business and won’t respond to your payment requests, ask someone else in their company. You might contact an accounting manager or accounts payable associate, or simply your contact’s boss. Let them know your struggle and that if they can’t resolve the issue, you’ll be taking further steps.

12. Send a Certified Letter

Before you contact an attorney or file a civil lawsuit, you should send a certified letter with the invoice and an explanation of your next steps. A certified letter creates proof of your attempts to contact the customer for payment. In a lot of cases, this simple action is enough to scare a customer into painting.

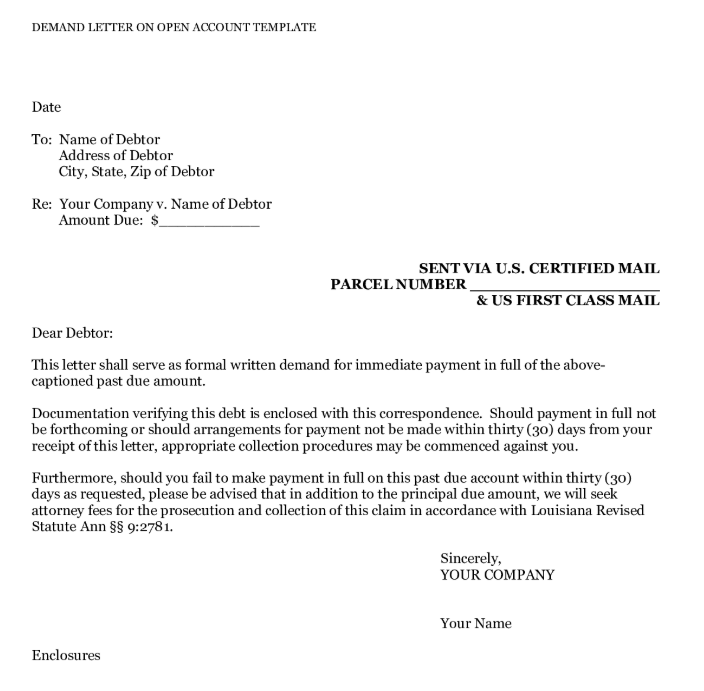

13. Send a Demand Letter from an Attorney

If your certified letter wasn’t enough, have an attorney write a demand letter along with a copy of the invoice. In many cases, seeing an attorney’s letterhead is enough for your client or customer to find a way to pay. They assume – and rightly so – that if you’re working with an attorney, your next step is a formal lawsuit.

Keep in mind that an attorney will charge a fee for this service, usually based on their time. If they have to spend hours understanding the account and your payment terms, the final demand letter could be expensive. This usually isn’t the best route for a small invoice.

14. Settle for Less Than Owed

If a client refuses to pay your full bill, consider accepting less than they owe to satisfy the full invoice. Yes, this is painful, but it could be more painful to seek the entire bill.

Keep in mind that some less-than-honest clients will hold your invoice hostage in hopes that you’ll take less just to get something. If you think they’re playing games with you, get a demand letter from a lawyer right away.

15. Look Into Invoice Financing

If you don’t have the time, resources, or inclination to chase an unpaid invoice, look into an invoice financing service (also called invoice factoring). These are companies that will buy your unpaid invoices, which gives them the right to collect in your place. They have the tools and resources to make clients pay.

If you sell your unpaid invoices, you won’t get their full value, obviously. The invoice financing service will pay you a percentage of the invoice based on the likelihood of collecting. In some cases, the price is a lot less than you would like, but it’s better than nothing.

16. Hire a Debt Collector

Debt collectors pursue the debt on your behalf. They take a percentage of whatever they collect, but the service is worth the cost because they are relentless about it. They will call and call until they get paid. People tend to panic when they receive a call from a collector because they know legal action is right around the corner.

17. File a Lawsuit

Depending on how much you’re owed, it may be worth your time to file a civil suit. Before you start, however, make sure you have plenty of documentation regarding…

- The services you provided

- The client agreeing to those services and those prices

- Invoices that are unpaid

- Attempts to contact the client about the balance

Keep in mind that lawsuits come with lawyer bills, filing fees, and court fees. They add up quickly. But if a client knows they owe you money, they might pay as soon as they receive the lawsuit paperwork.

Unfortunately, winning in court just creates a legal judgment. It doesn’t guarantee you’ll get paid. After your win, you’ll need to take additional steps, such as levying your clients’ accounts, filing a lien on their property, or garnishing their paychecks.

Don’t Give Up

Don’t abandon your attempts to collect if your client hasn’t paid in a while. Stay polite and professional, but slowly move to more aggressive collection tactics. You provided services. You deserve to be paid. Good luck!

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.