High-Risk Merchant Accounts: What They Are and Why You May Need One

Last updated on

In order to sell online, you need the ability to accept credit cards. Checks and ACH transfers are inefficient and hard to track. If you can’t take credit cards through your website, most of your customers will move on to another merchant.

But some businesses have trouble finding reliable credit card processing. They can’t use the mainstream processors (like PayPal, Stripe, Square, etc.) and many banks won’t touch them.

Why? Because they’re high-risk.

If you’re one of these high-risk businesses who don’t qualify for traditional processing, there’s still hope. You are not prohibited from selling online. You just need a high-risk merchant account with a bank who understands your situation and works with businesses like yours.

So what’s a high-risk merchant account? Before we get into that, you need to understand how general merchant accounts work.

Merchant Accounts

A merchant account is a type of bank account approved by a financial institution that lets businesses accept credit and debit cards as payment from customers.

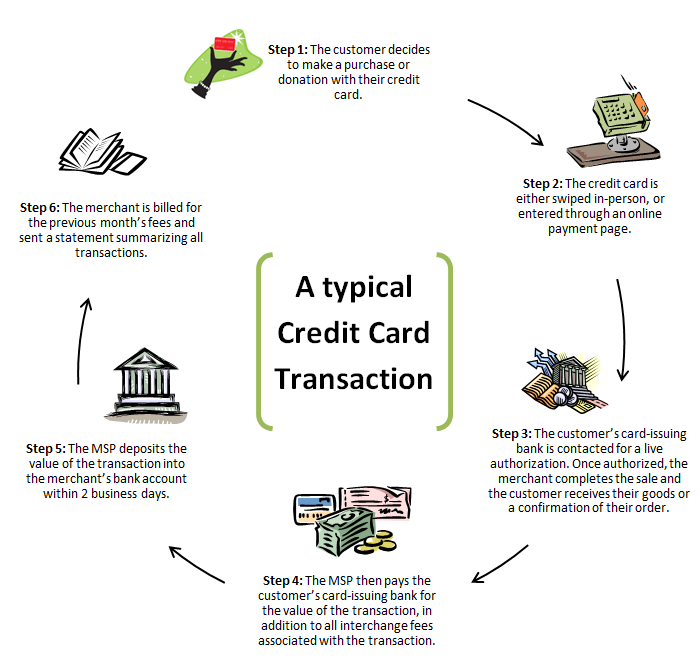

You can’t use a merchant account like your checking account. You can’t spend the money or access it directly. Instead, the money collected in your merchant account via credit card transactions gets deposited into your business or personal account. This process usually takes 1-2 business days at a minimum.

Here’s an example of the typical credit card transaction process. Step three is where your merchant account completes the sale.

Unlike a personal or business account, you can’t just open a merchant account on a whim. There will be an underwriting process that evaluates your credit and banking history. You’ll also have to supply your business license, past processing history, and other supporting documents.

A bank will also need to gauge your risk. It wants to make sure that they won’t be on the hook if a customer files a chargeback because you failed to deliver a product or service. They also want to make sure your business is legal and ethical.

Naturally, there are fees (aren’t there always?). Merchant accounts come with different fee schedules depending on where you get the account, but you can expect monthly service fees, chargeback fees, reporting fees, and – the big one – transaction fees.

Stripe, for example, is a big merchant account. They let Stripe users bill customers and collect money in the merchant account. Then Stripe distributes the money from the merchant account to their users’ accounts. Presumably, Stripe charges its users higher fees than it pays, so it keeps the difference.

High-Risk Businesses

Some businesses are riskier to work with than others. Banks determine the risk level of the businesses they work with during the underwriting process. They’re willing to take on some risk, but there’s a limit.

A bank might consider you high risk for one or more of these reasons:

- Your product or service has a long chargeback period. For example, if you sell annual memberships to a course, your customers would have 18 months to issue a chargeback (service length plus six months).

- Your industry has a history of high chargebacks. This includes online gambling, pharmaceuticals, tourism services, marijuana, dating services, or Forex trading.

- The account has “reputational risk,” meaning they just don’t want to associate with you. This includes adult products and services, e-cigarettes and tobacco, timeshares, etc.

- Based on your credit history and company financials, banks don’t believe you’ll be able to support the sales volume you’re applying for.

- You have poor personal credit.

- You sell abnormally expensive products like custom auto parts, high-end jewelry, or vehicles.

- You are on the Terminated Merchant File or MATCH list, which are businesses who have had their merchant accounts revoked in the past.

Some banks and credit card processors play it safe by prohibiting certain businesses from their programs and platforms due to their risk. Stripe, for example, has a big list of prohibited businesses who can’t use their service.

If you fall into any of these categories, there’s a good chance the mainstream platforms won’t accept your business and you’ll have to work with a high-risk processor.

- Annual memberships

- Adult products

- Cannabis products

- Bail bonds

- Business opportunities

- Electronics sold online

- Investment & credit services

- Debt service

- Virtual currency or stored value

- Horoscope/Fortune telling

- Firearm dealers

- Multi-level marketing (MLM)

- Online auctions

- Bankruptcy lawyers

- Jamming and interference devices

- Prepaid phone cards

- Credit card and identity theft protection

- Counterfeit or unauthorized goods

- Online dating sites

- Mugshot publication or pay-to-remove sites

- Software downloads

- Telemarketing

- Telecommunications

- Video game or virtual world credits

- Timeshare Advertising

- Travel services

- Drug paraphernalia

It’s worth pointing out, however, that this list isn’t definitive. You may be part of one of those prohibited Industries, but not in a way that restricts you from using mainstream credit card processors like Stripe.

For instance, let’s say you sold informational courses to help people sell products on eBay. Technically you’re in the “online auctions” industry, but you aren’t an online auction. It wouldn’t be a problem as long as your website and product offerings are clear about the distinction.

High-Risk Merchant Accounts

It’s still possible to obtain credit card processing even if you’re considered a high-risk business. You just need a special high-risk merchant account.

Banks have a few tricks to manage the risk from their high-risk accounts. Some banks put a cap on the number of high-risk merchant accounts they’ll create and stop accepting high-risk businesses once they reach that limit. In other cases, banks simply charge high-risk businesses a lot of money in fees to compensate for the risk.

There are also third-party middlemen who can help you find a high-risk merchant account. Essentially, they shop your business around to a network of banks until they find one who will take your level of risk. Naturally, the middleman takes a small cut.

Finding a processor who will work with you can be tricky, however. Your options are limited and the high-risk processors know that, which means they have leverage. How do they wield that leverage? By charging extra fees.

Here are some fees you can expect from a high-risk payment processor that you wouldn’t normally experience with a mainstream payment processor or a bank.

- Set up fees – Just to open your account and connect your website.

- Termination fees – They often charge these even if you aren’t under contract.

- Capture fees – If you need a terminal in a physical location.

- Chargeback fees – You pay these if someone issues a chargeback. They start at $25 per instance, but could cost hundreds of dollars. You may have to pay these even if you think the customer is behaving fraudulently.

- Non-compliance fees – Your processor could penalize you if they believe you’ve violated PCI compliance best practices.

- Penalty fees – Some processors tack on additional fees for contract violations. For instance, if your agreement prevents you from processing cards through any other system, your high-risk processor could fine you if they learn about that one time you had someone pay you via PayPal.

- Monthly fees – You’ll undoubtedly pay something per month just to keep the account open. Some plans cost $10/month. Others cost $500/month. It depends on your business and the bank who agrees to open a merchant account for you.

- Processing fees – These are the big ones. They seem small, but they add up quickly. Most high-risk processors charge percentage and flat fees on top of the interchange rate (the fee that goes to the credit card providers). For instance, you might pay “interchange + 4.9% + $0.75.” If the interchange for a Mastercard is 2.2%, you’ll pay 7.1% + $0.75 on that transaction. On a $350 order, that’s $25.60 just to take the money.

Don’t Lose Hope

Don’t panic if you’re a high-risk business who can’t access a traditional payment processor. You may have to jump through extra hoops to set up processing (unlike, for example, the ease of signing up with Stripe) and you’ll certainly pay some extra fees, but all legal business can get processing. You just have to go a bit farther to find it.

One last piece of advice: Don’t settle with the first high-risk processor who accepts your business. Shop around for better deals until you’re happy with one. A few hours of research can save you a lot of money!

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.