How to Collect Taxes on Payments

In This Document

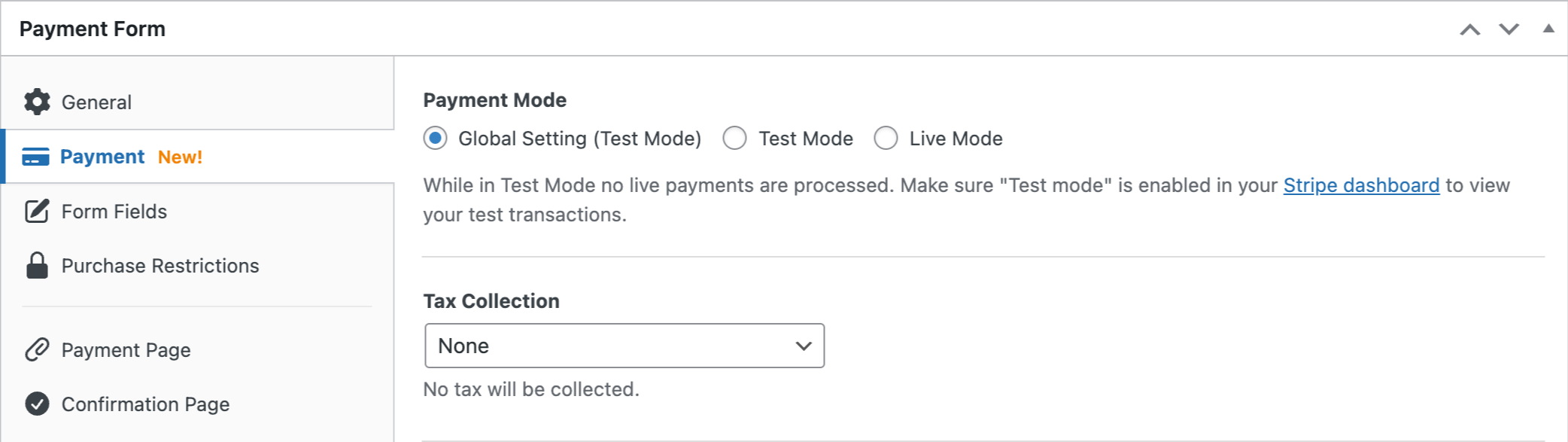

Tax collection is managed on a per-form basis in the Payment tab of the form builder. To display the tax/fee breakdown on your payment forms, use the Amount Breakdown custom form field.

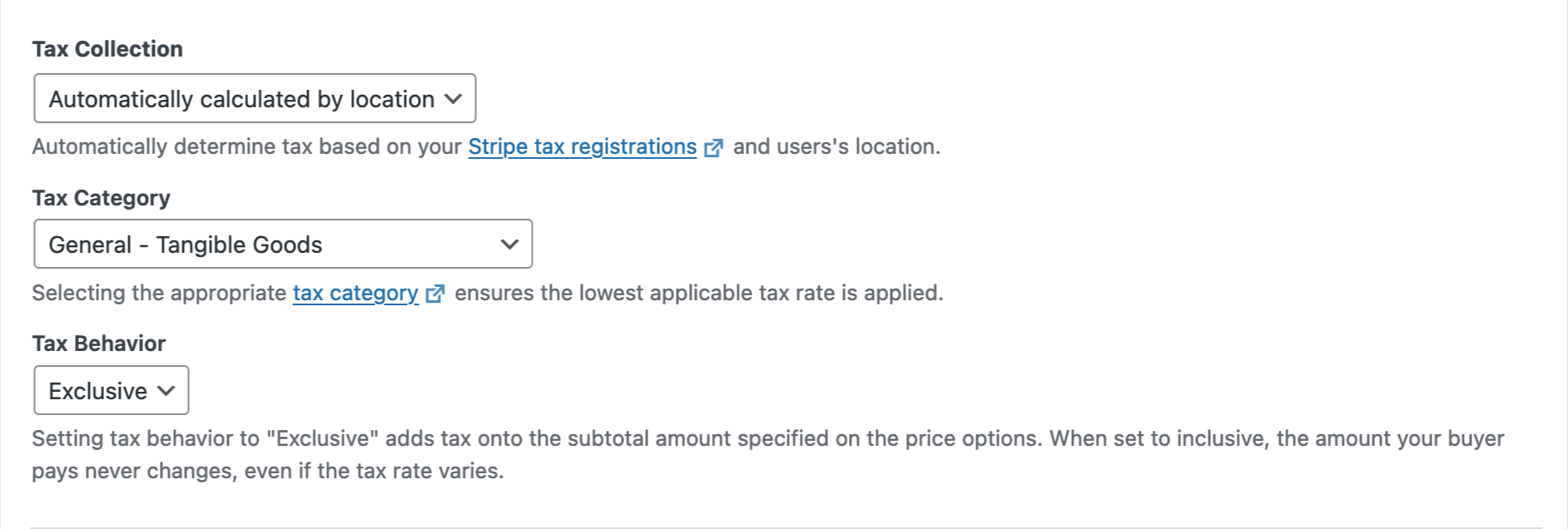

Automatic Calculation by Location

To charge tax amounts based on your business registration and customer location, choose the Automatically calculated by location option in the Tax Collection dropdown.

Stripe Tax is available for sales in Australia, Canada, the EU-27, Hong Kong, Iceland, Japan, New Zealand, Norway, Singapore, South Africa, the United Arab Emirates, the United Kingdom, and the United States.

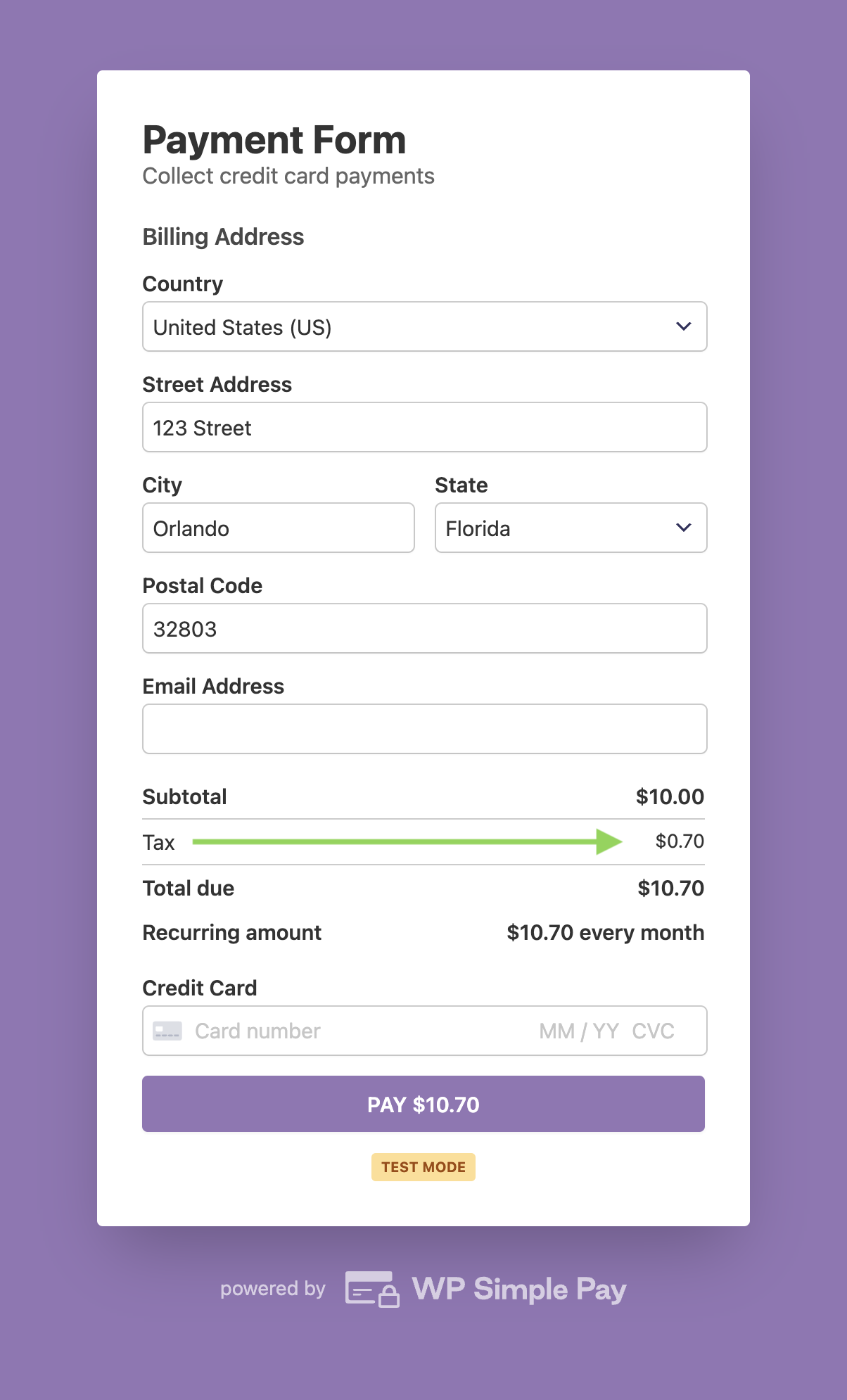

Based on the customer’s address, Stripe calculates the tax accurately and precisely at the rooftop level in over 11,000 tax jurisdictions (country, state, county, city, district).

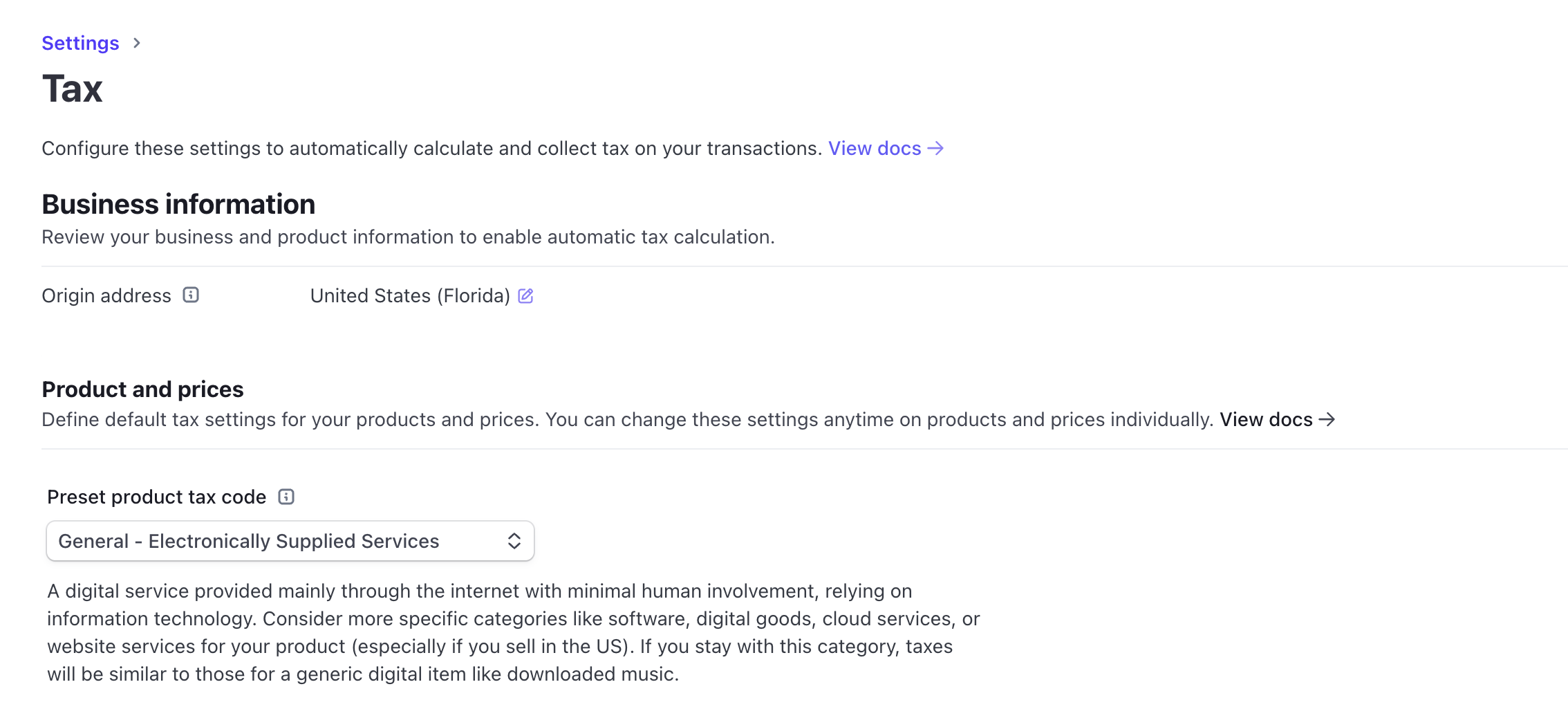

Activating Stripe Tax

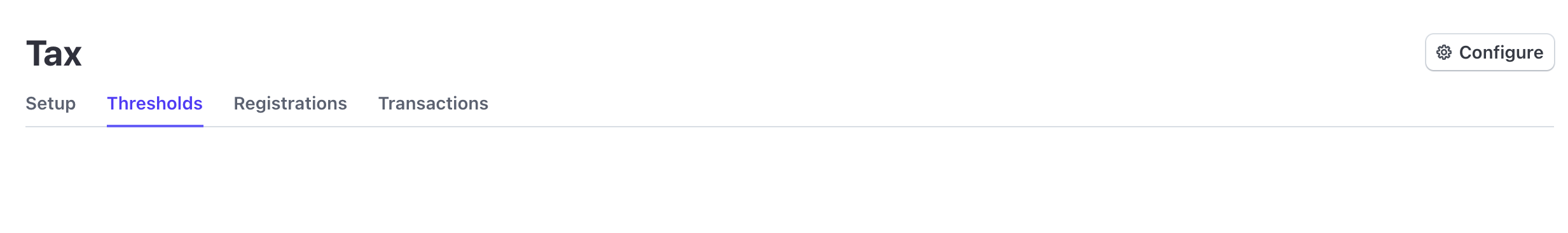

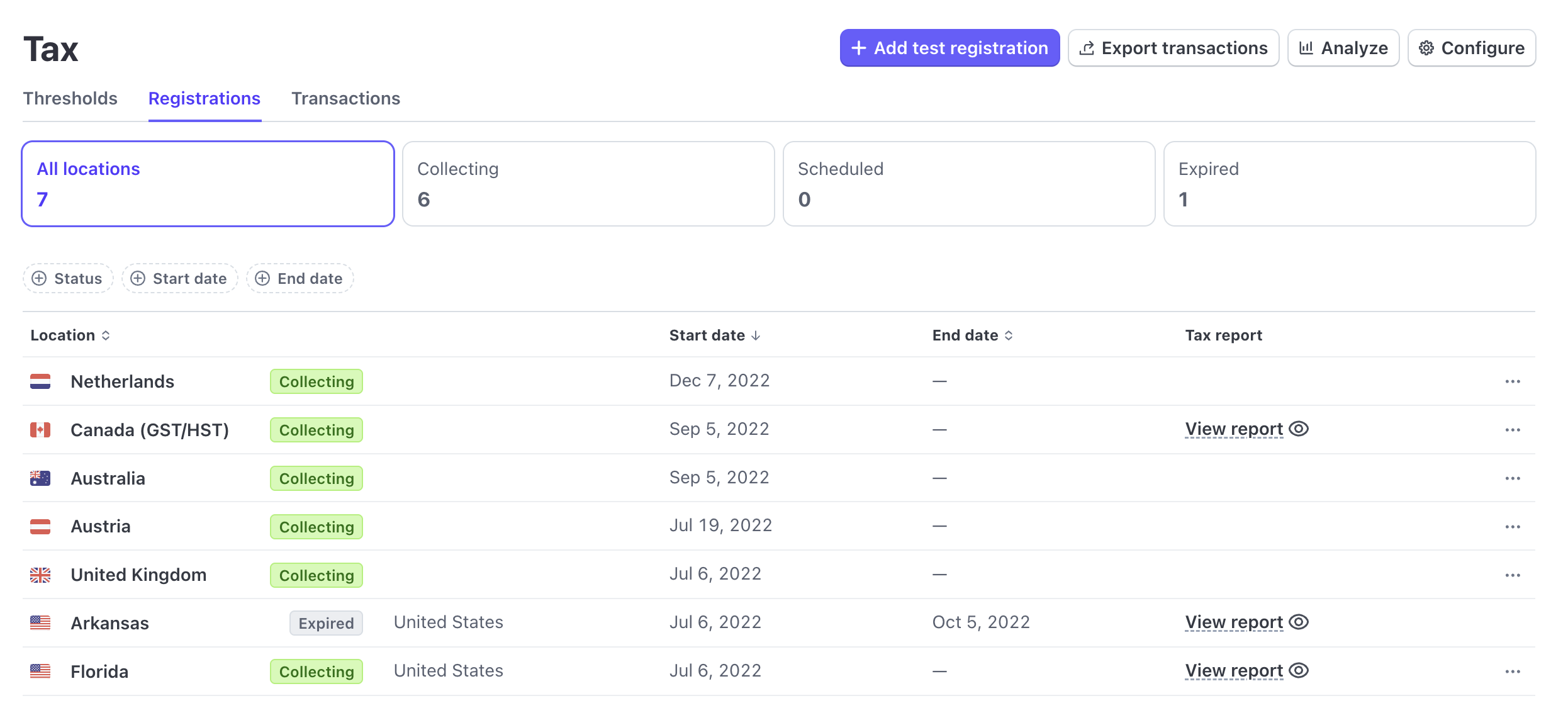

Before you can automatically calculate tax amounts, you must first activate Stripe Tax in the Stripe dashboard. You can monitor tax thresholds before adding tax registrations, as you might not need to register if your business only sells nontaxable products in a jurisdiction. After a threshold has been reached, a registration can be added to start collecting taxes for those locations.

Tax Registration

You define your business’s origin address and add tax registration jurisdictions to start collecting immediately or to schedule collection later.

From https://dashboard.stripe.com/tax/thresholds you can click “Configure” to edit the registration settings, or visit https://dashboard.stripe.com/settings/tax directly.

Fees

You must manually activate Stripe Tax in your account because calculating tax for a registered jurisdiction adds an additional 0.5% fee to the transaction. You are only charged for using Stripe Tax on transactions to customers in states or countries where you are registered to collect tax. A $0.00 tax amount will still incur an additional fee if a tax registration exists for that jurisdiction. Learn more on Stripe.com

Using Automatic Calculation in WP Simple Pay

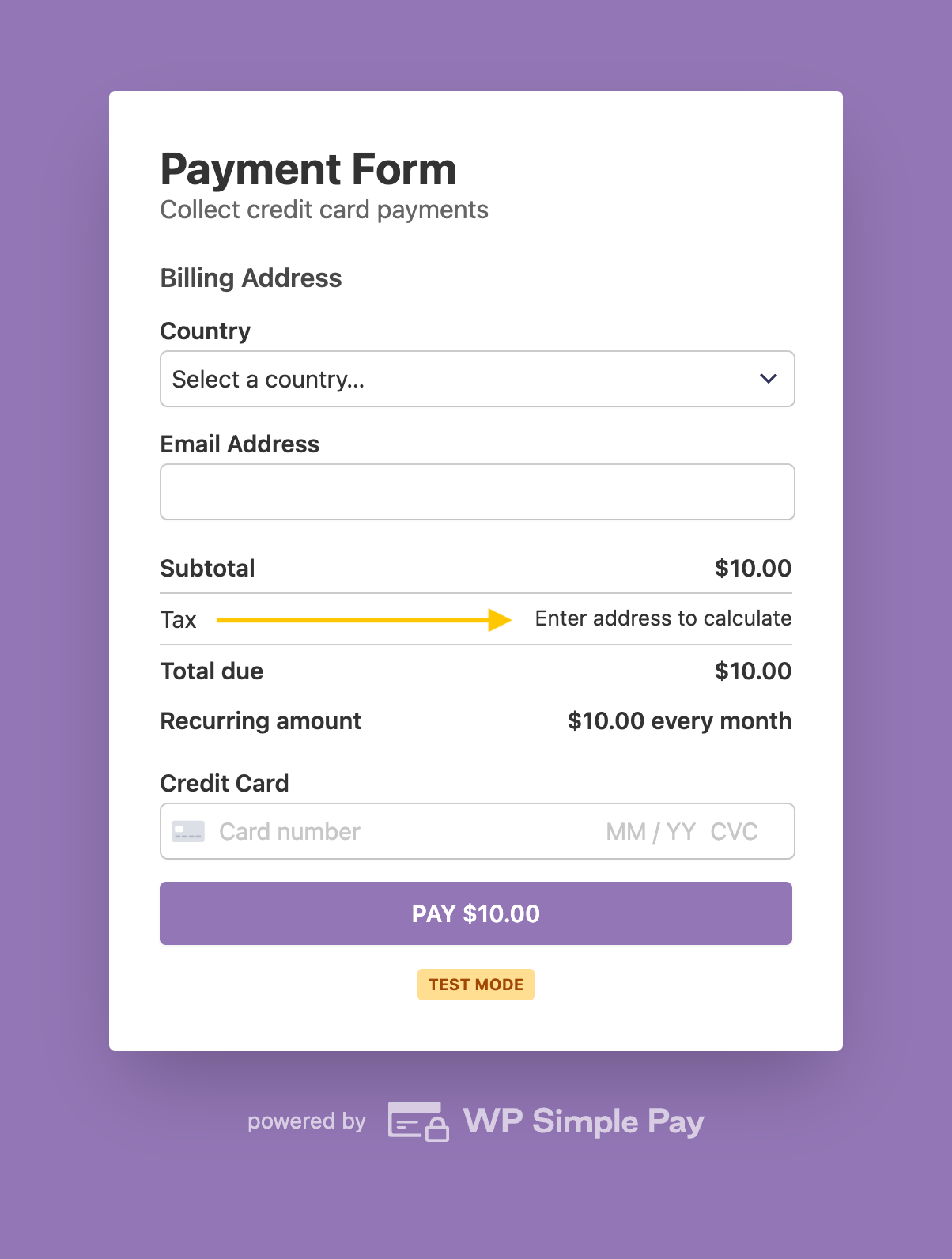

When enabled on a payment form, the Billing Address and Amount Breakdown fields will automatically be added if they did not previously exist. This allows tax calculation to occur at the most accurate level and ensures that customers know what they are being charged for.

Once a complete address is entered on the payment form the tax amount is calculated and displayed. When using the Address field with automatic tax calculation only the country field is shown initially. This ensures the state fields can be pre-populated with valid choices in locations that require choosing from a fixed list of available states.

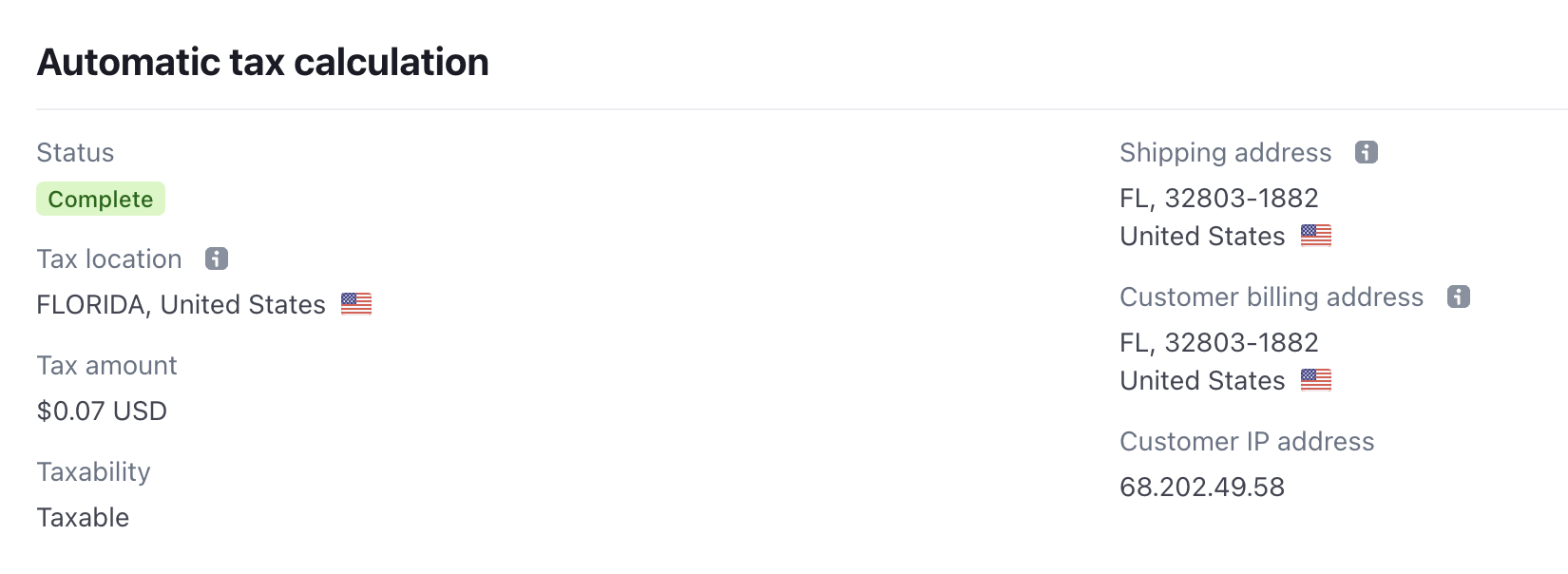

Viewing Tax Amounts in Stripe

The Stripe Dashboard lets you view tax amount breakdowns on payments or subscription records.

Fixed Tax Rates

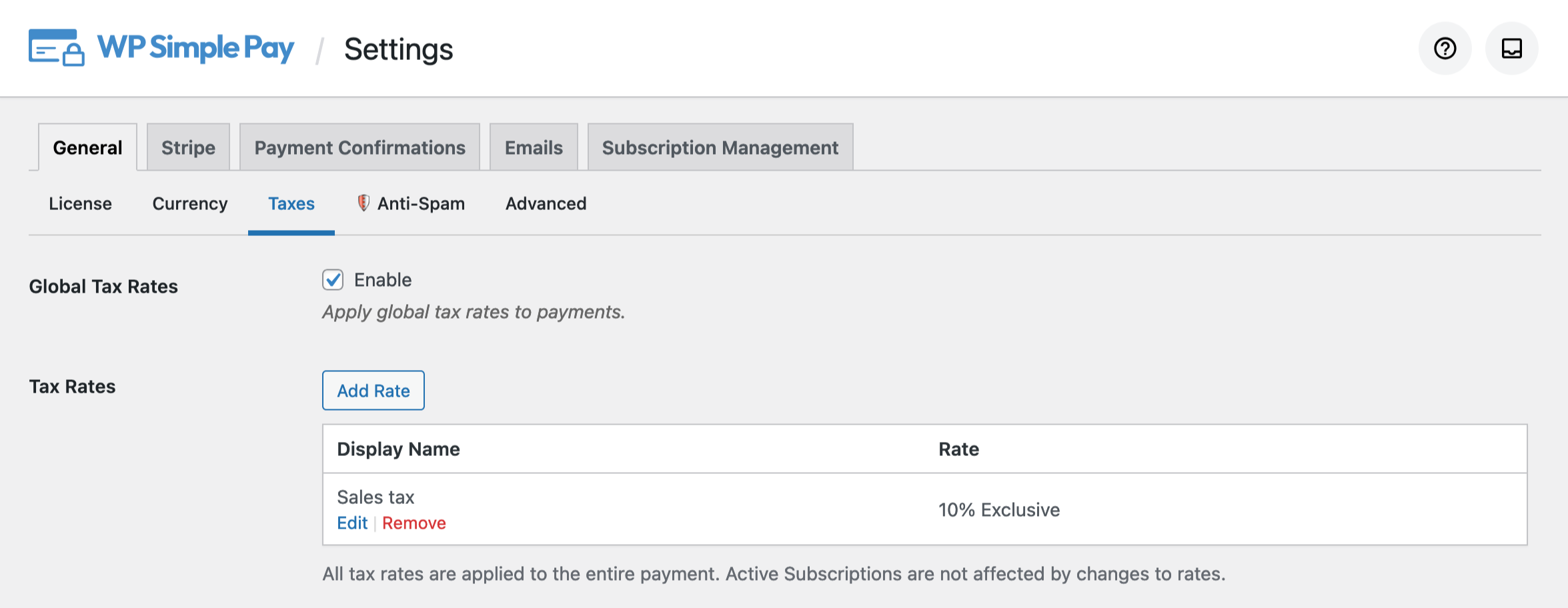

To charge fixed tax rates, select the Global Tax Rates option in the Tax Collection dropdown. Tax rates can be managed by visiting WP Simple Pay → Settings → General → Taxes.

No Tax

To disable tax collection altogether on a particular payment form, select the None option in the Tax Collection dropdown.

Still have questions? We’re here to help!

Last Modified: